Since July 2024, Best Buy has been in a holding pattern, posting a small return of 4.1% while floating around $85.65. This is close to the S&P 500’s 7.5% gain during that period.

Is now the time to buy Best Buy, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.We're sitting this one out for now. Here are three reasons why there are better opportunities than BBY and a stock we'd rather own.

Why Is Best Buy Not Exciting?

With humble beginnings as a stereo equipment seller, Best Buy (NYSE: BBY) now sells a broad selection of consumer electronics, appliances, and home office products.

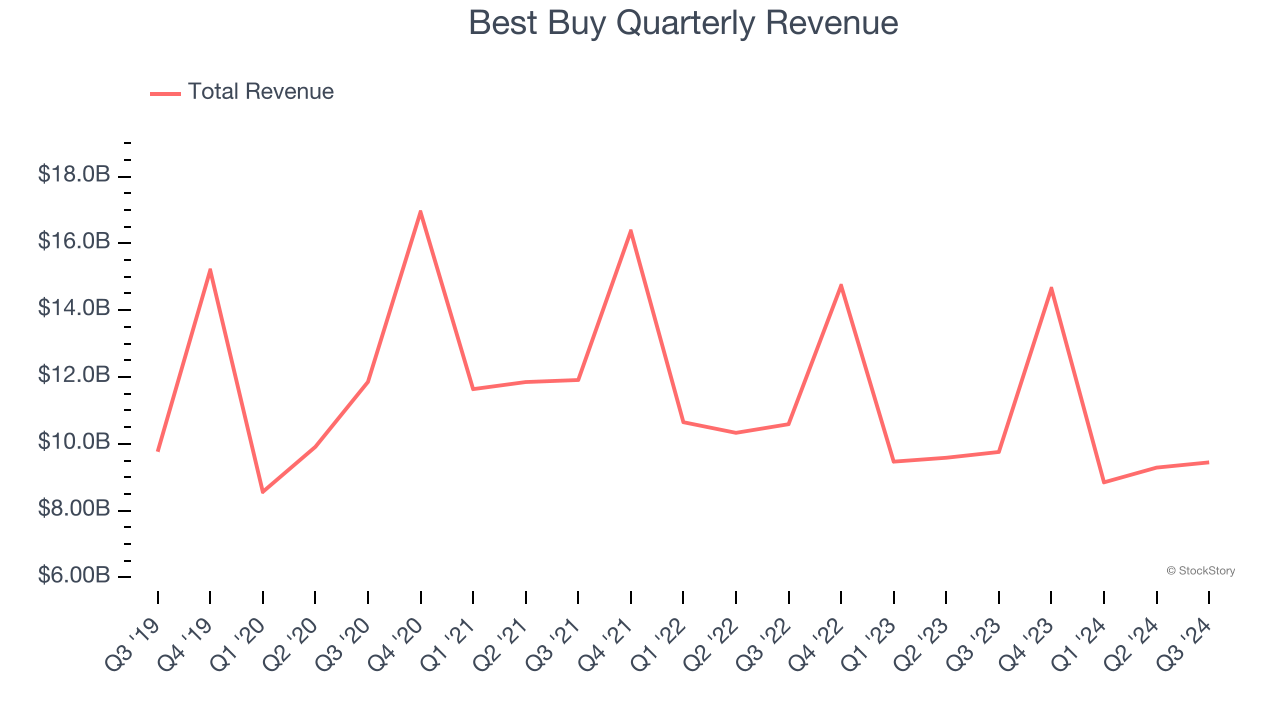

1. Long-Term Revenue Growth Flatter Than a Pancake

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Best Buy struggled to consistently increase demand as its $42.23 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of lacking business quality.

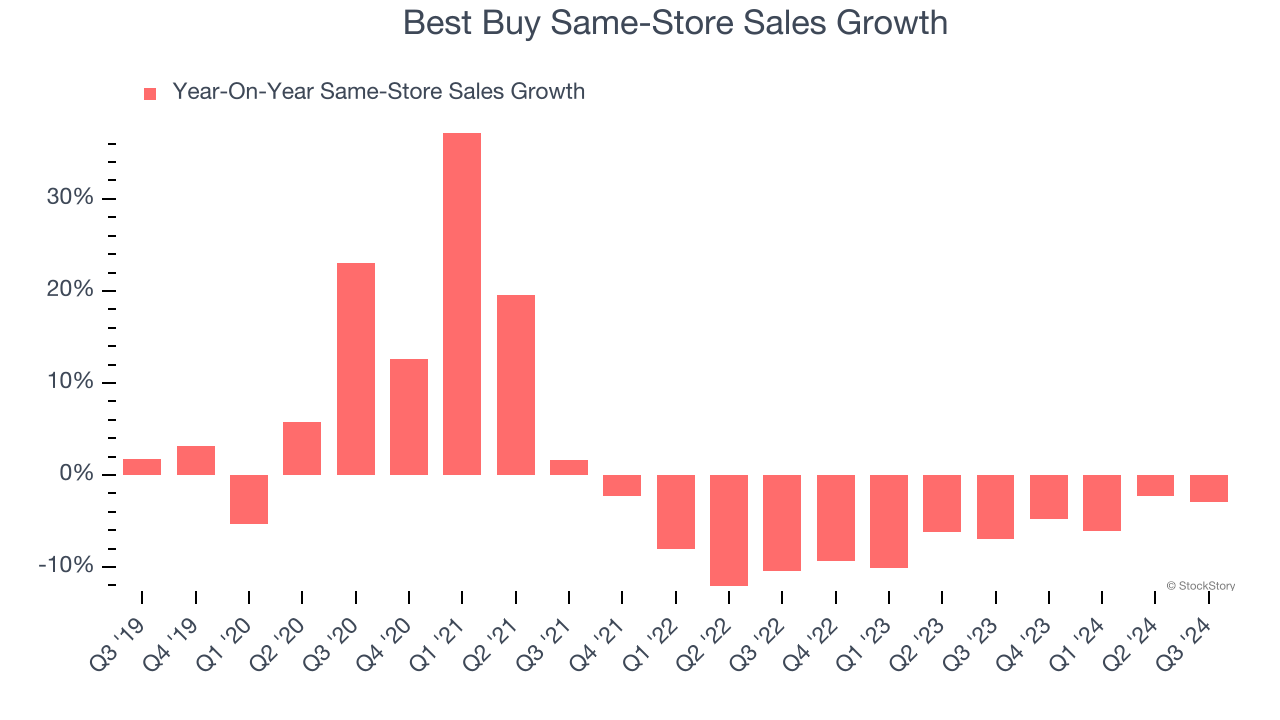

2. Shrinking Same-Store Sales Indicate Waning Demand

Same-store sales is an industry measure of whether revenue is growing at existing stores, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Best Buy’s demand has been shrinking over the last two years as its same-store sales have averaged 6.1% annual declines.

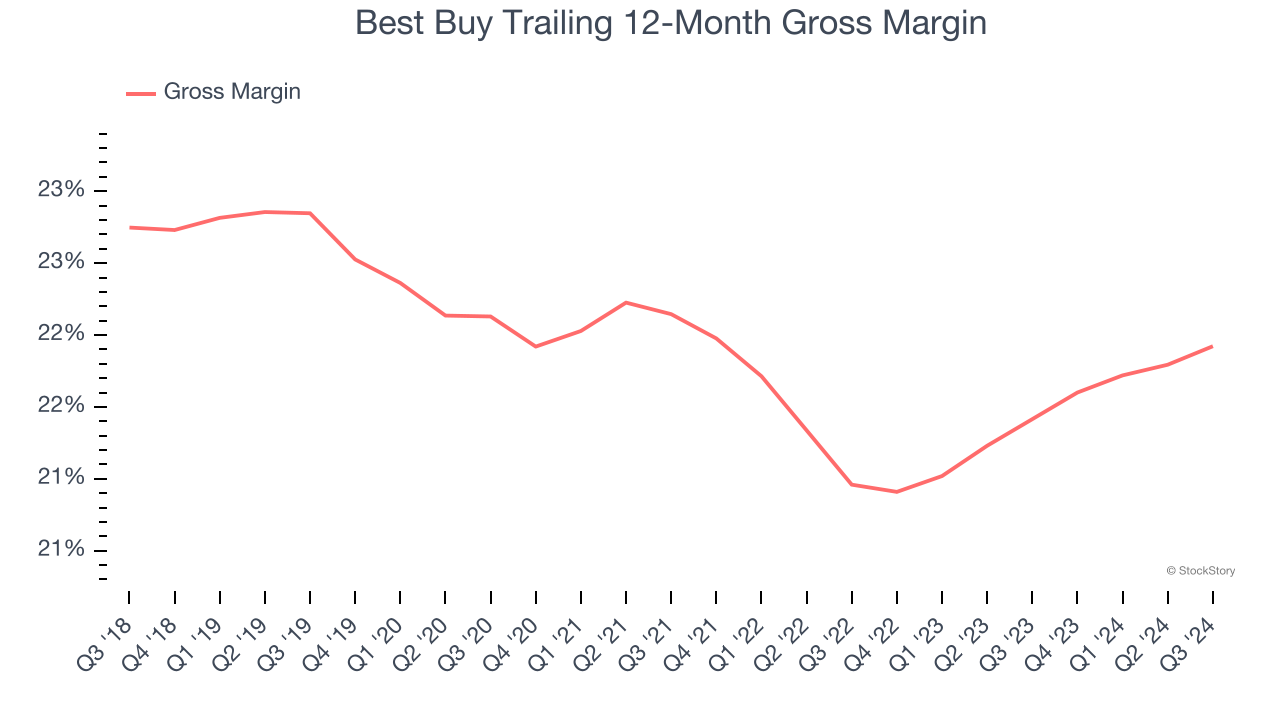

3. Low Gross Margin Reveals Weak Structural Profitability

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Best Buy has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 22.2% gross margin over the last two years. That means Best Buy paid its suppliers a lot of money ($77.84 for every $100 in revenue) to run its business.

Final Judgment

Best Buy isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 12.8× forward price-to-earnings (or $85.65 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d recommend looking at Google, whose cloud computing and YouTube divisions are firing on all cylinders.

Stocks We Would Buy Instead of Best Buy

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.