Over the past six months, Uber’s shares (currently trading at $61.04) have posted a disappointing 14.1% loss, well below the S&P 500’s 8.8% gain. This might have investors contemplating their next move.

Following the pullback, is now the time to buy UBER? Find out in our full research report, it’s free.

Why Are We Positive On Uber?

Born out of a winter night thought: "What if you could request a ride from your phone?" Uber (NYSE: UBER) operates a global network of on demand services, most prominently ride hailing and food delivery, and freight.

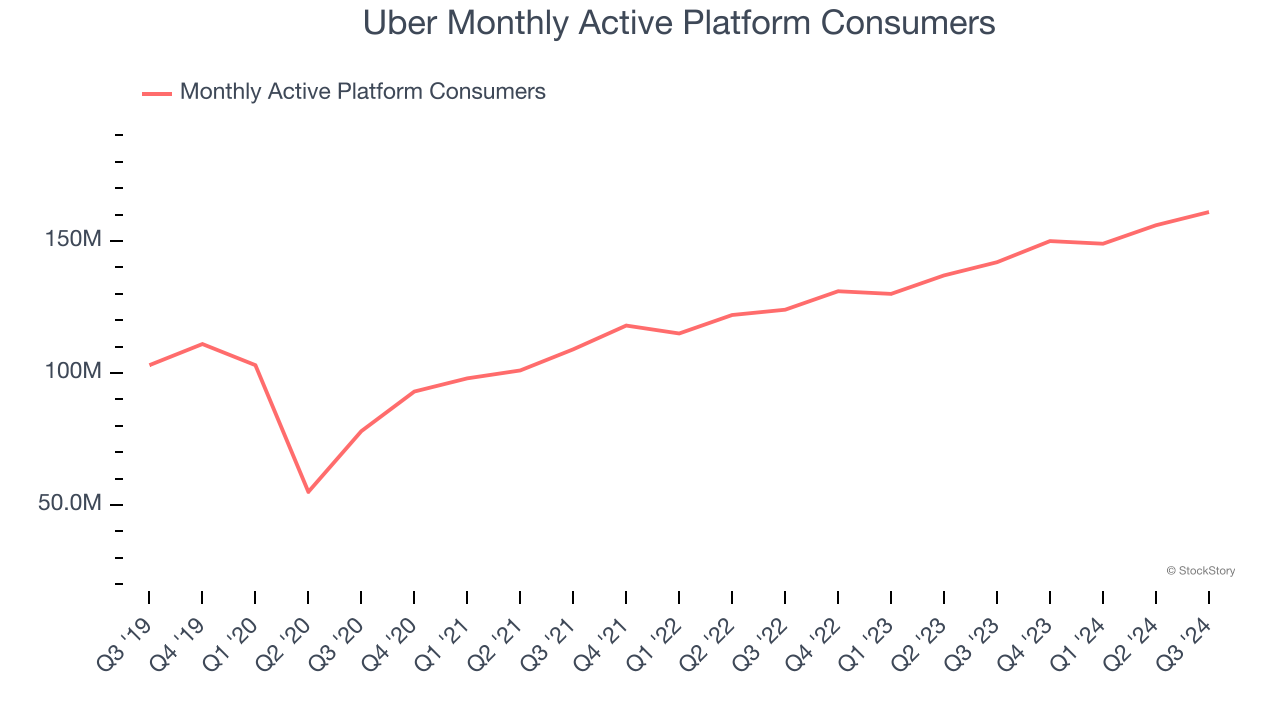

1. Monthly Active Platform Consumers Skyrocket, Fueling Growth Opportunities

As a gig economy marketplace, Uber generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

Over the last two years, Uber’s monthly active platform consumers, a key performance metric for the company, increased by 13.4% annually to 161 million in the latest quarter. This growth rate is strong for a consumer internet business and indicates people love using its offerings.

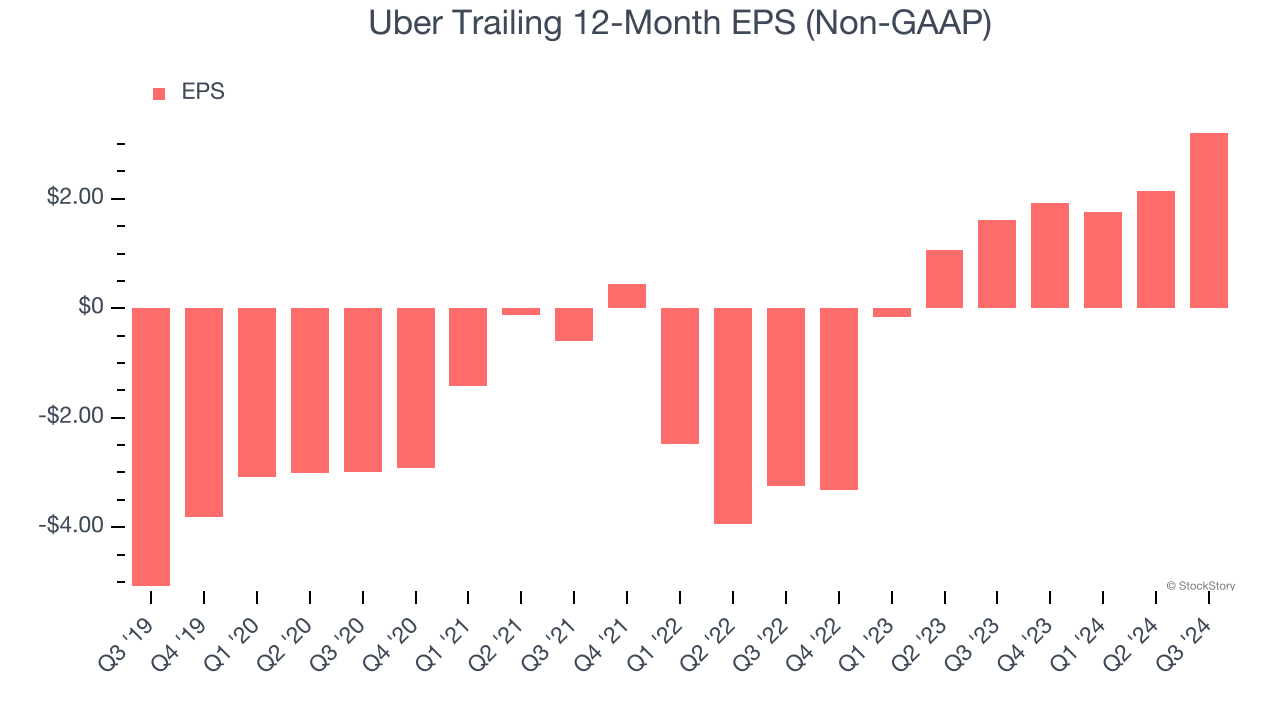

2. Outstanding Long-Term EPS Growth

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Uber’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

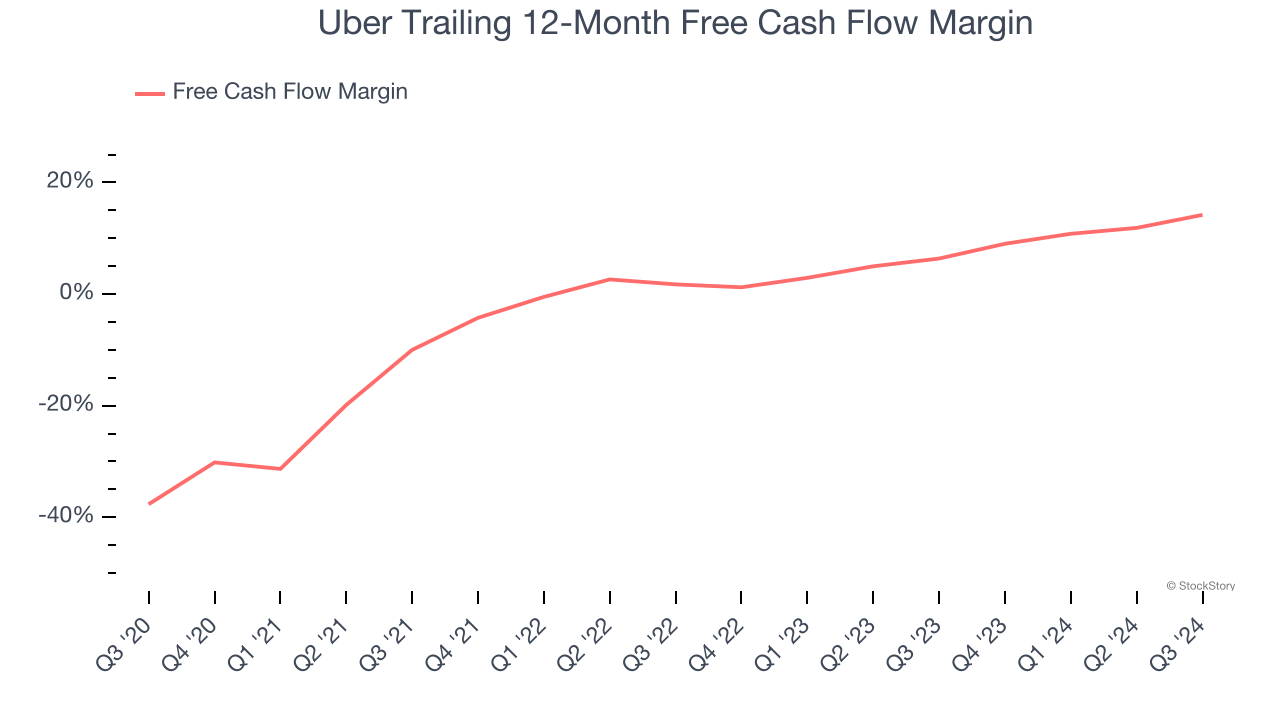

3. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Uber’s margin expanded by 24.2 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose by more than its operating profitability. Uber’s free cash flow margin for the trailing 12 months was 14.2%.

Final Judgment

These are just a few reasons Uber is a high-quality business worth owning. After the recent drawdown, the stock trades at 16.4× forward EV-to-EBITDA (or $61.04 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Uber

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.