Lovesac has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 12.9% to $24.77 per share while the index has gained 8.8%.

Is there a buying opportunity in Lovesac, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.We're cautious about Lovesac. Here are three reasons why there are better opportunities than LOVE and a stock we'd rather own.

Why Is Lovesac Not Exciting?

Known for its oversized, premium beanbags, Lovesac (NASDAQ: LOVE) is a specialty furniture brand selling modular furniture.

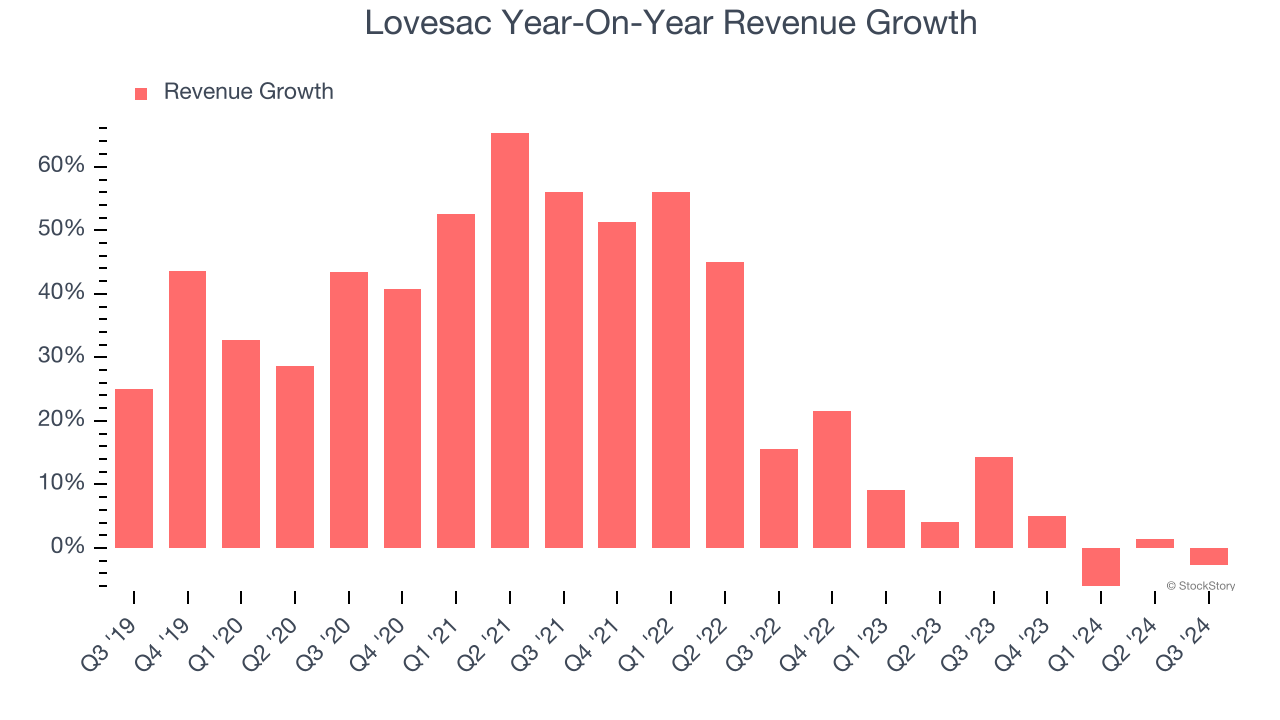

1. Lackluster Revenue Growth

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Lovesac’s recent history shows its demand slowed significantly as its annualized revenue growth of 6.4% over the last two years is well below its five-year trend.

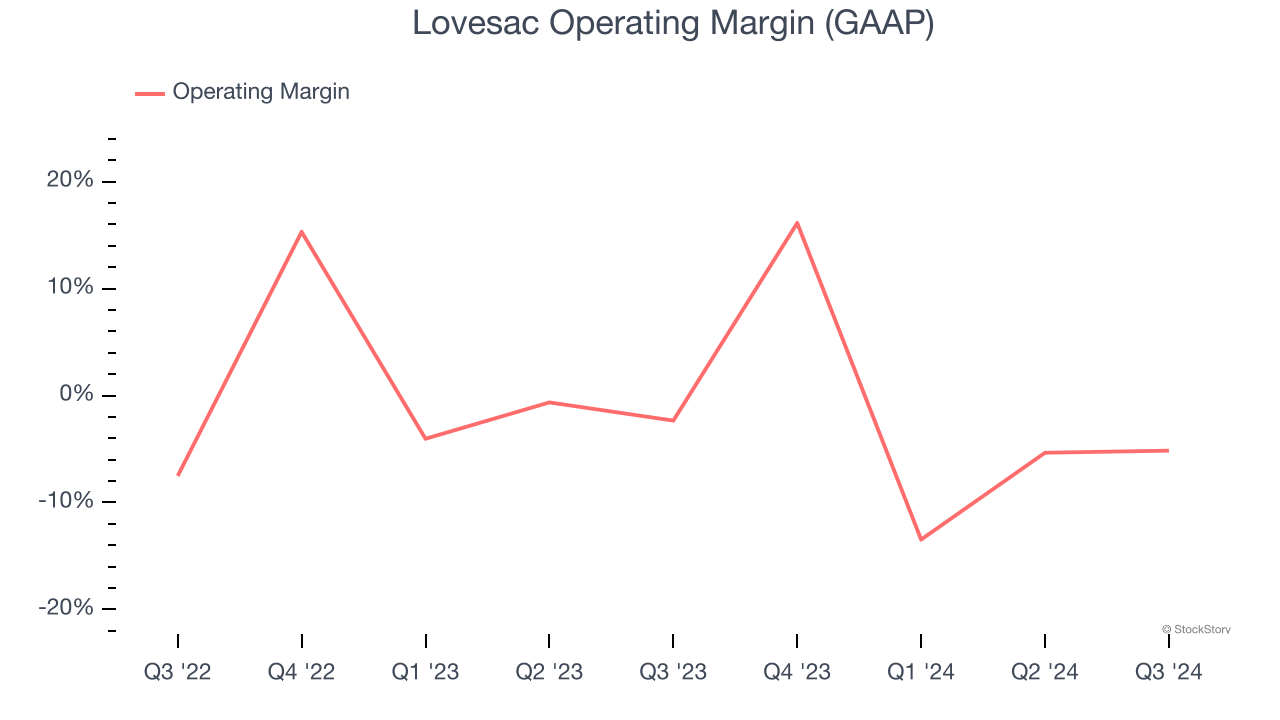

2. Weak Operating Margin Could Cause Trouble

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Lovesac’s operating margin has shrunk over the last 12 months and averaged 2.4% over the last two years. Although this result isn’t good, the company’s elite historical revenue growth suggests it ramped up investments to capture market share. We’ll keep a close eye to see if this strategy pays off.

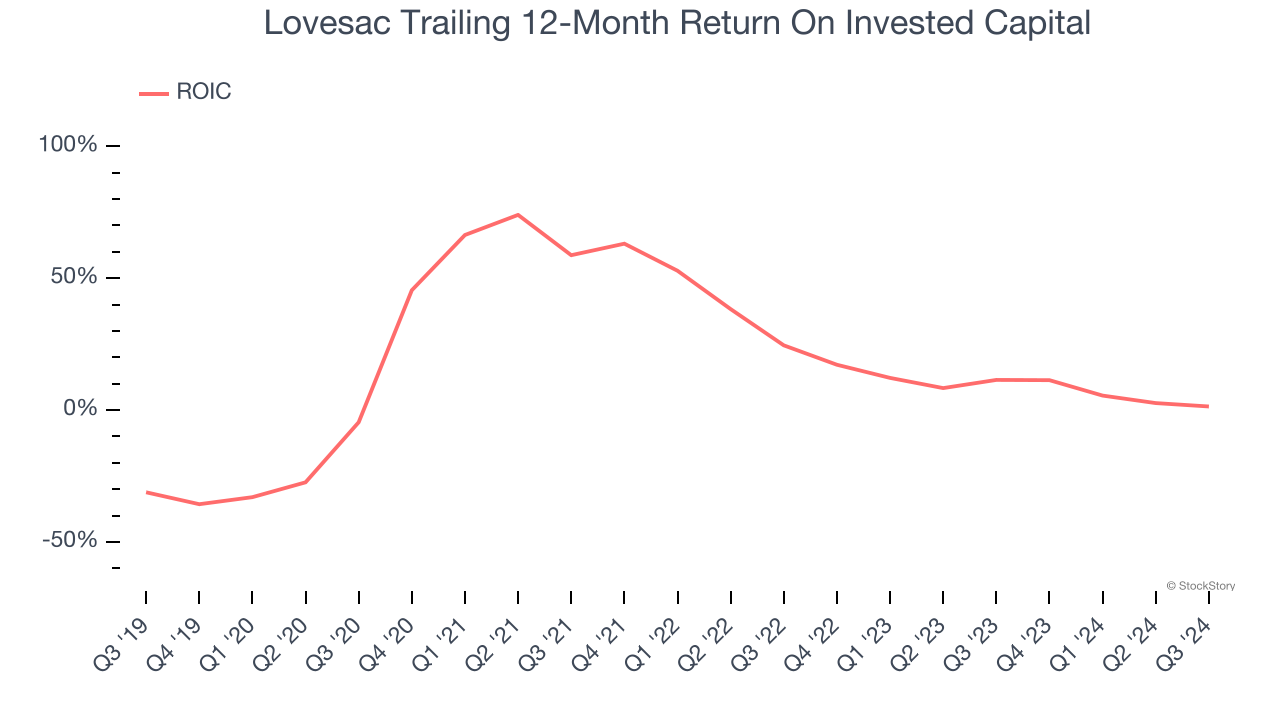

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. Unfortunately, Lovesac’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Lovesac isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 16× forward price-to-earnings (or $24.77 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. Let us point you toward Microsoft, the most dominant software business in the world.

Stocks We Like More Than Lovesac

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.