Comcast has been treading water for the past six months, recording a small loss of 0.6% while holding steady at $37.95. The stock also fell short of the S&P 500’s 8.8% gain during that period.

Is there a buying opportunity in Comcast, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.We don't have much confidence in Comcast. Here are three reasons why there are better opportunities than CMCSA and a stock we'd rather own.

Why Do We Think Comcast Will Underperform?

Formerly known as American Cable Systems, Comcast (NASDAQ: CMCSA) is a multinational telecommunications company offering a wide range of services.

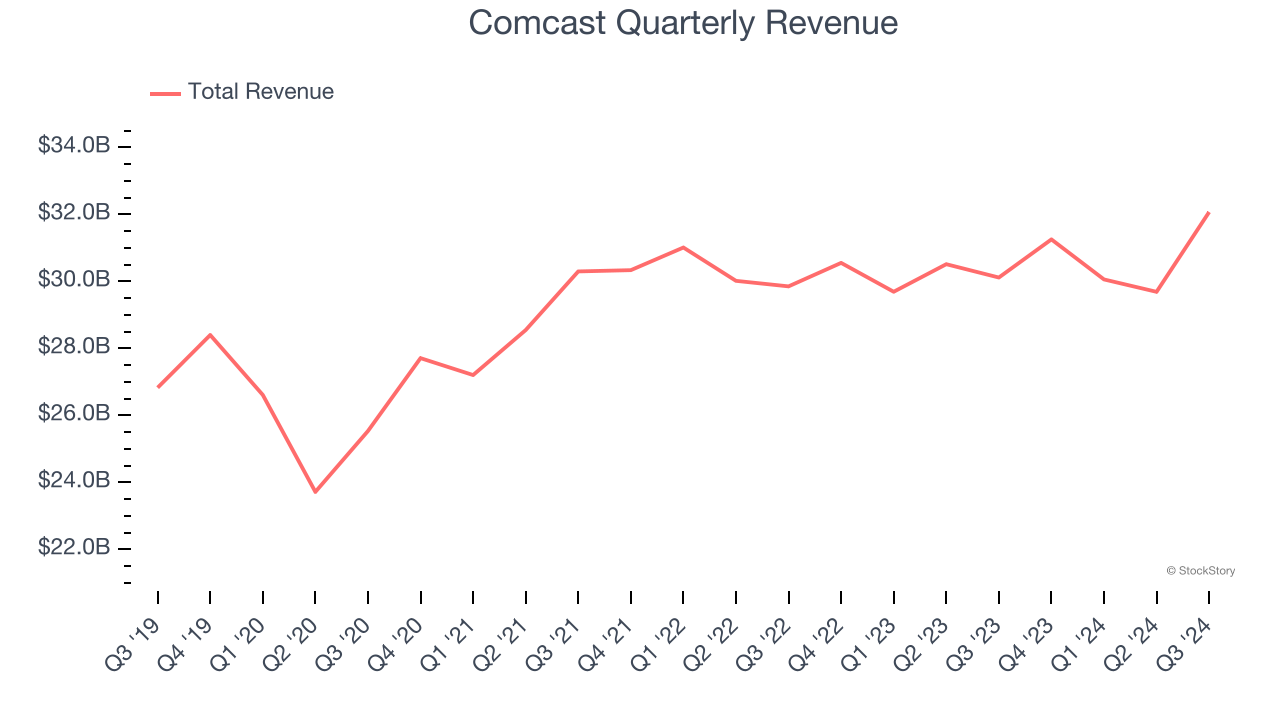

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Comcast grew its sales at a weak 2.5% compounded annual growth rate. This fell short of our benchmarks.

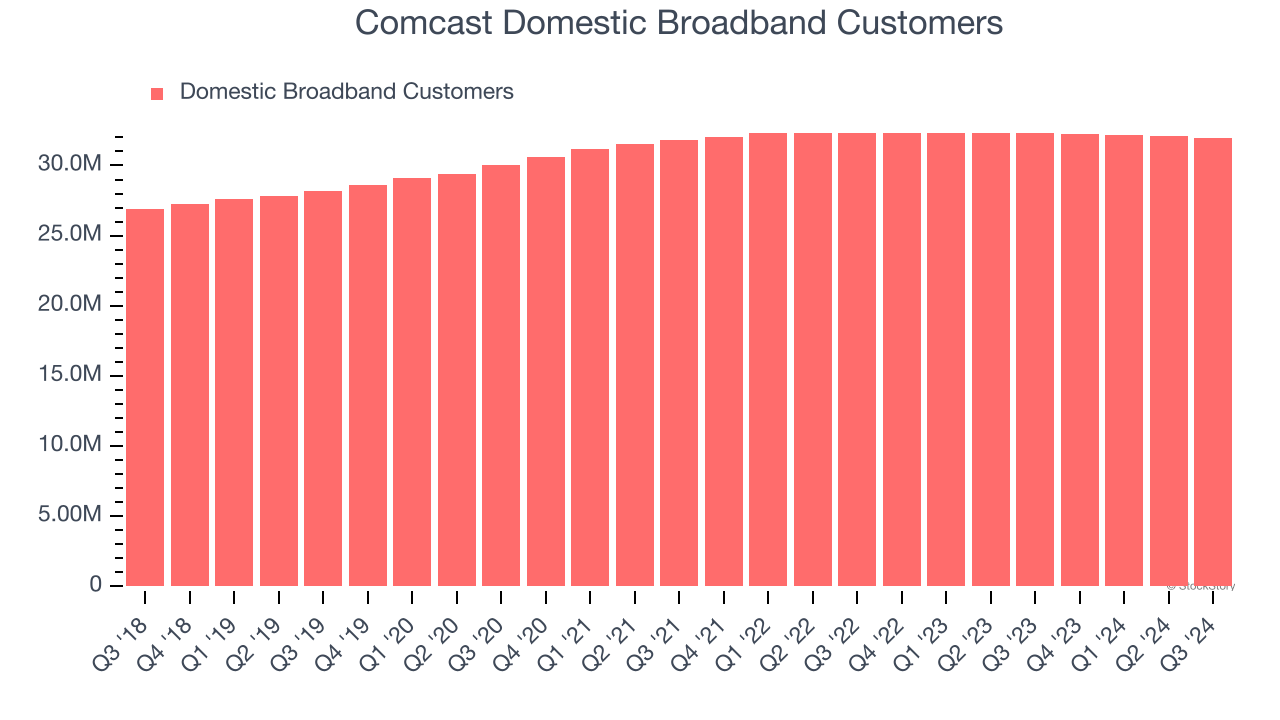

2. Inability to Grow Domestic Broadband Customers Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like Comcast, our preferred volume metric is domestic broadband customers). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Over the last two years, Comcast failed to grow its domestic broadband customers, which came in at 31.98 million in the latest quarter. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Comcast might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

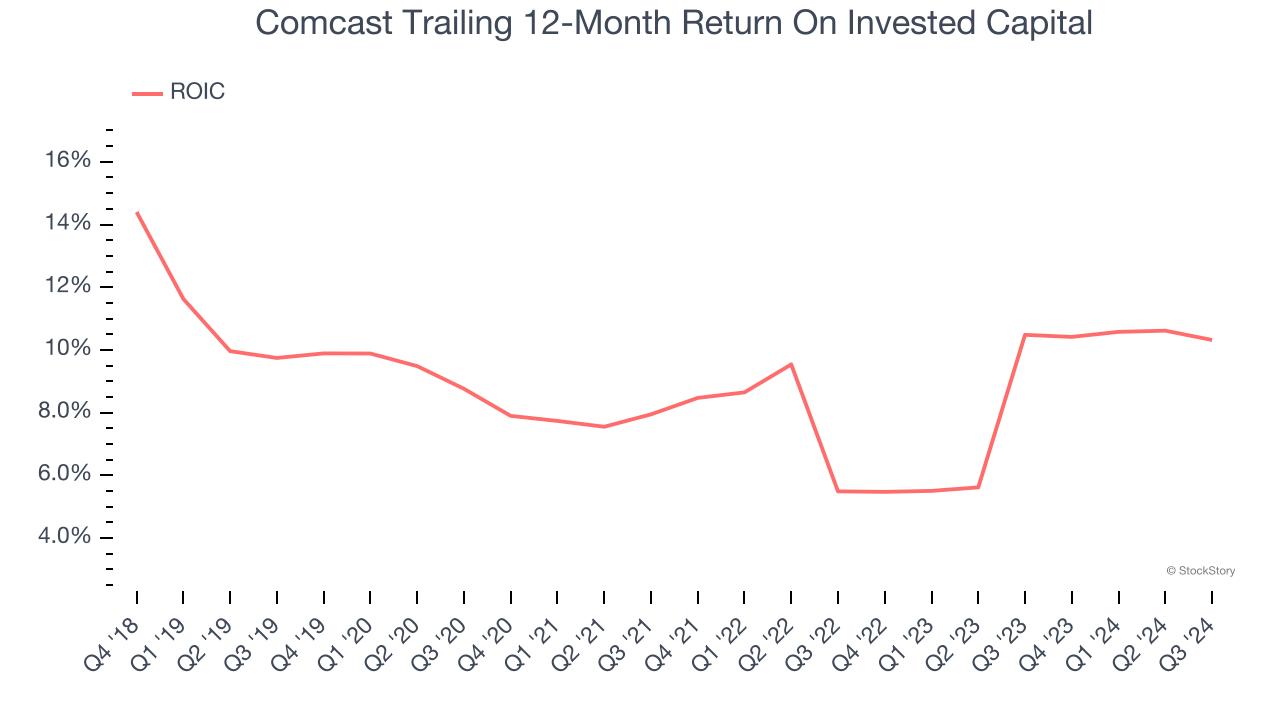

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Comcast historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.6%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

Final Judgment

Comcast falls short of our quality standards. With its shares trailing the market in recent months, the stock trades at 8.7× forward price-to-earnings (or $37.95 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. We’d recommend looking at The Trade Desk, the nucleus of digital advertising.

Stocks We Like More Than Comcast

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.