Since December 2019, the S&P 500 has delivered a total return of 84.8%. But one standout stock has doubled the market - over the past five years, Rush Enterprises has surged 167% to $55.03 per share. Its momentum hasn’t stopped as it’s also gained 33.5% in the last six months thanks to its solid quarterly results, beating the S&P by 24.7%.

Is there a buying opportunity in Rush Enterprises, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.We’re happy investors have made money, but we're cautious about Rush Enterprises. Here are three reasons why there are better opportunities than RUSHA and a stock we'd rather own.

Why Do We Think Rush Enterprises Will Underperform?

Headquartered in Texas, Rush Enterprises (NASDAQ: RUSH.A) provides truck-related services and solutions, including sales, leasing, parts, and maintenance for commercial vehicles.

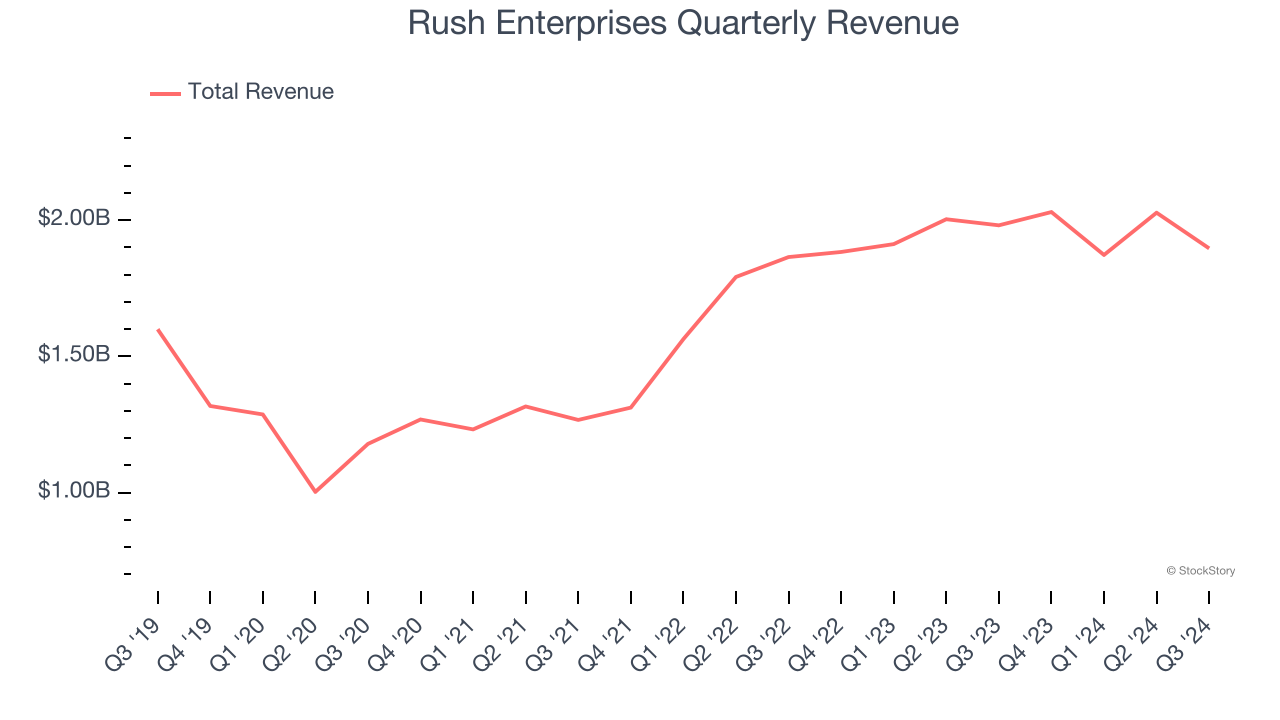

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Rush Enterprises’s 5.3% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the industrials sector.

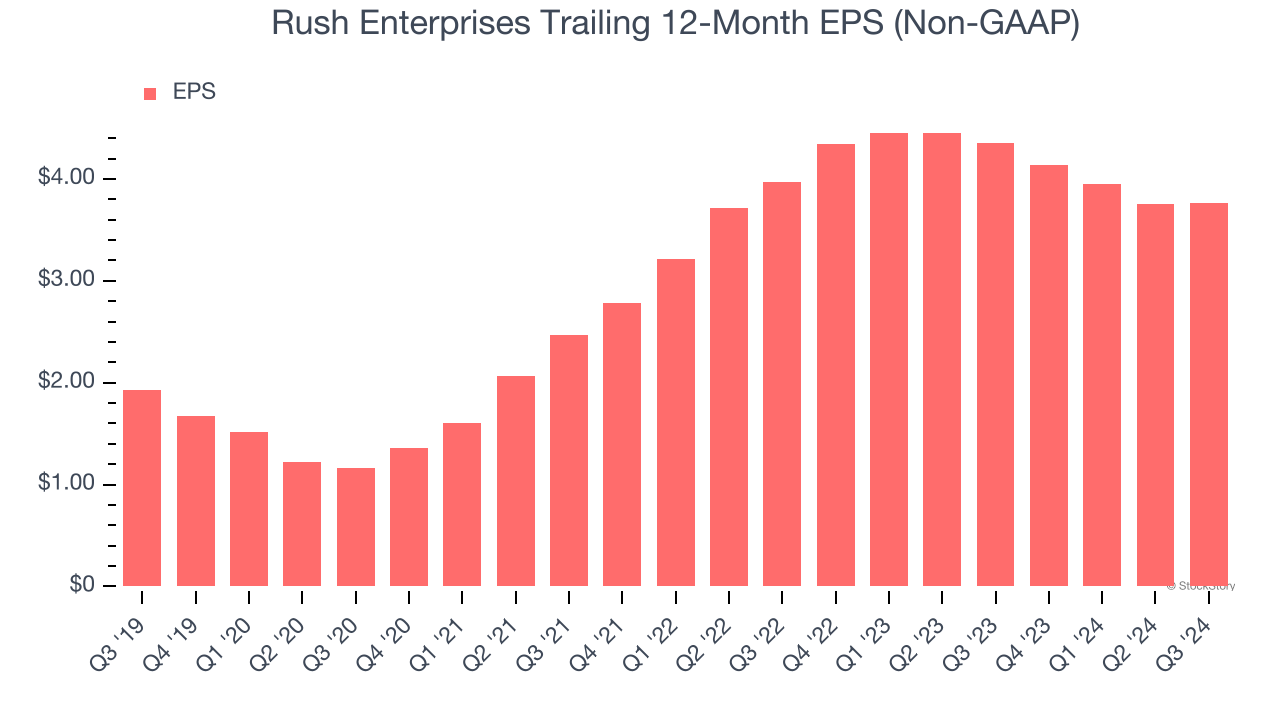

2. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Rush Enterprises, its EPS declined by 2.6% annually over the last two years while its revenue grew by 9.5%. This tells us the company became less profitable on a per-share basis as it expanded.

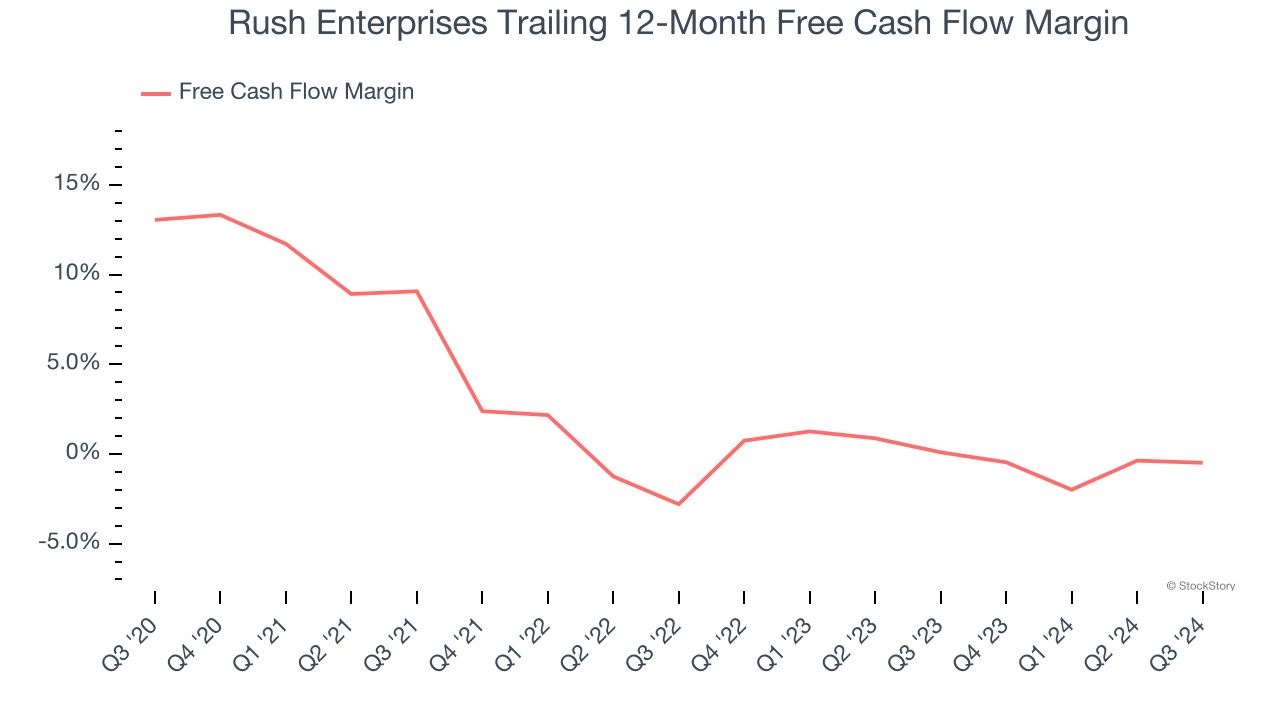

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Rush Enterprises’s margin dropped by 13.5 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. Rush Enterprises’s free cash flow margin for the trailing 12 months was breakeven.

Final Judgment

We see the value of companies helping their customers, but in the case of Rush Enterprises, we’re out. With its shares outperforming the market lately, the stock trades at 15.6× forward price-to-earnings (or $55.03 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are more exciting stocks to buy at the moment. We’d suggest looking at The Trade Desk, the nucleus of digital advertising.

Stocks We Would Buy Instead of Rush Enterprises

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.