Over the past six months, Edgewell Personal Care’s stock price fell to $33.46. Shareholders have lost 16.4% of their capital, which is disappointing considering the S&P 500 has climbed by 8.8%. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Edgewell Personal Care, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.Despite the more favorable entry price, we're cautious about Edgewell Personal Care. Here are three reasons why you should be careful with EPC and a stock we'd rather own.

Why Is Edgewell Personal Care Not Exciting?

Boasting brands such as Banana Boat, Schick, and Skintimate, Edgewell Personal Care (NYSE: EPC) sells personal care products in the skin and sun care, shave, and feminine care categories.

1. Long-Term Revenue Growth Disappoints

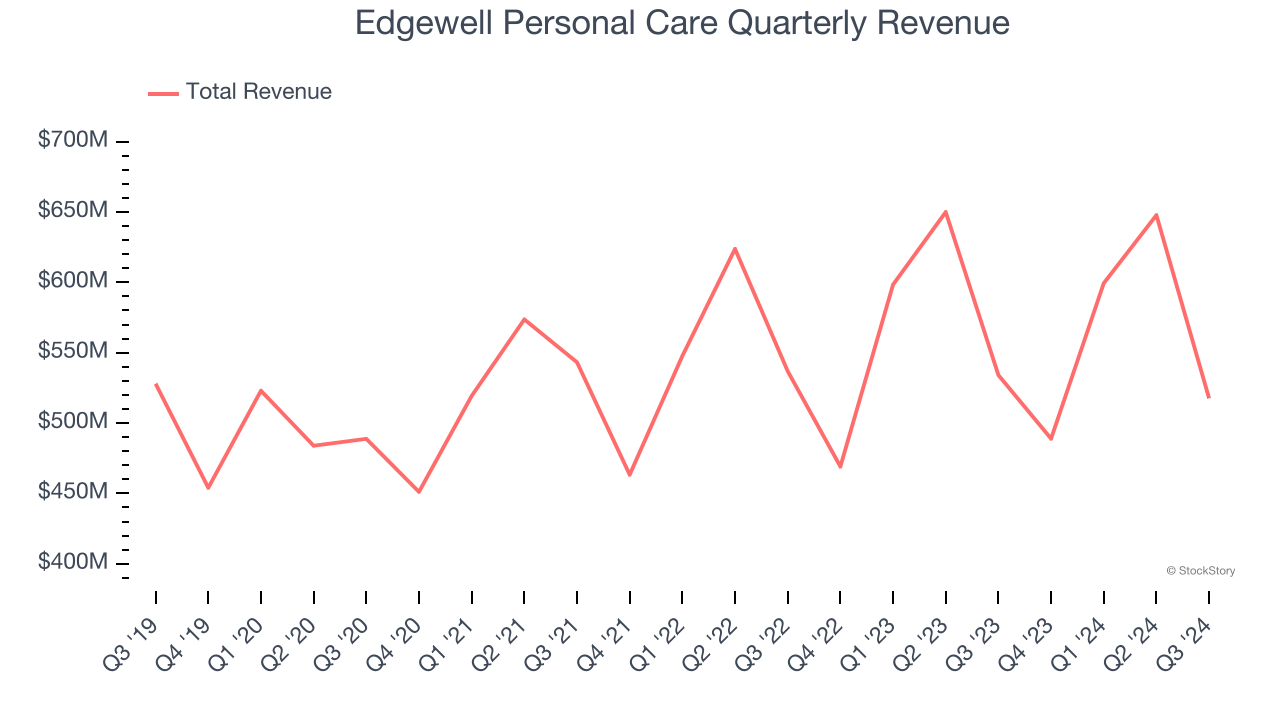

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Edgewell Personal Care grew its sales at a sluggish 2.6% compounded annual growth rate. This was below our standards.

2. Slow Organic Growth Suggests Waning Demand In Core Business

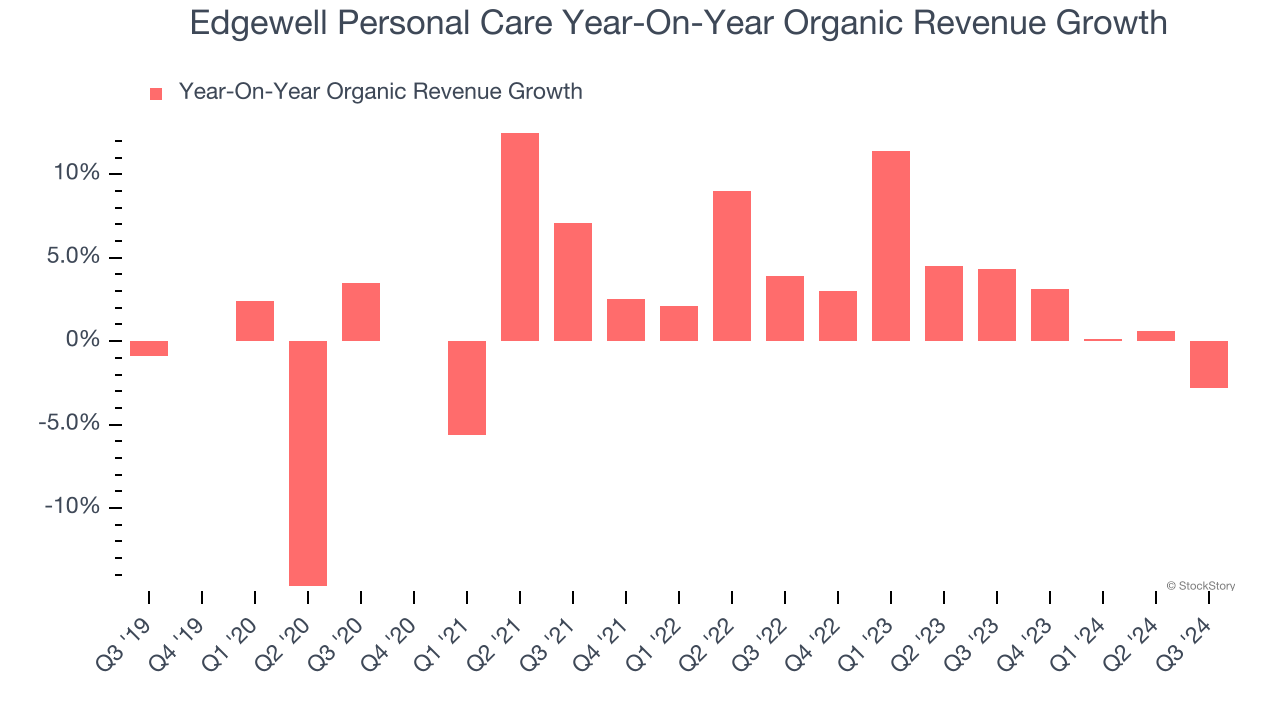

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Edgewell Personal Care’s products has generally risen over the last two years but lagged behind the broader sector. On average, the company’s organic sales have grown by 3% year on year.

3. Previous Growth Initiatives Haven’t Paid Off Yet

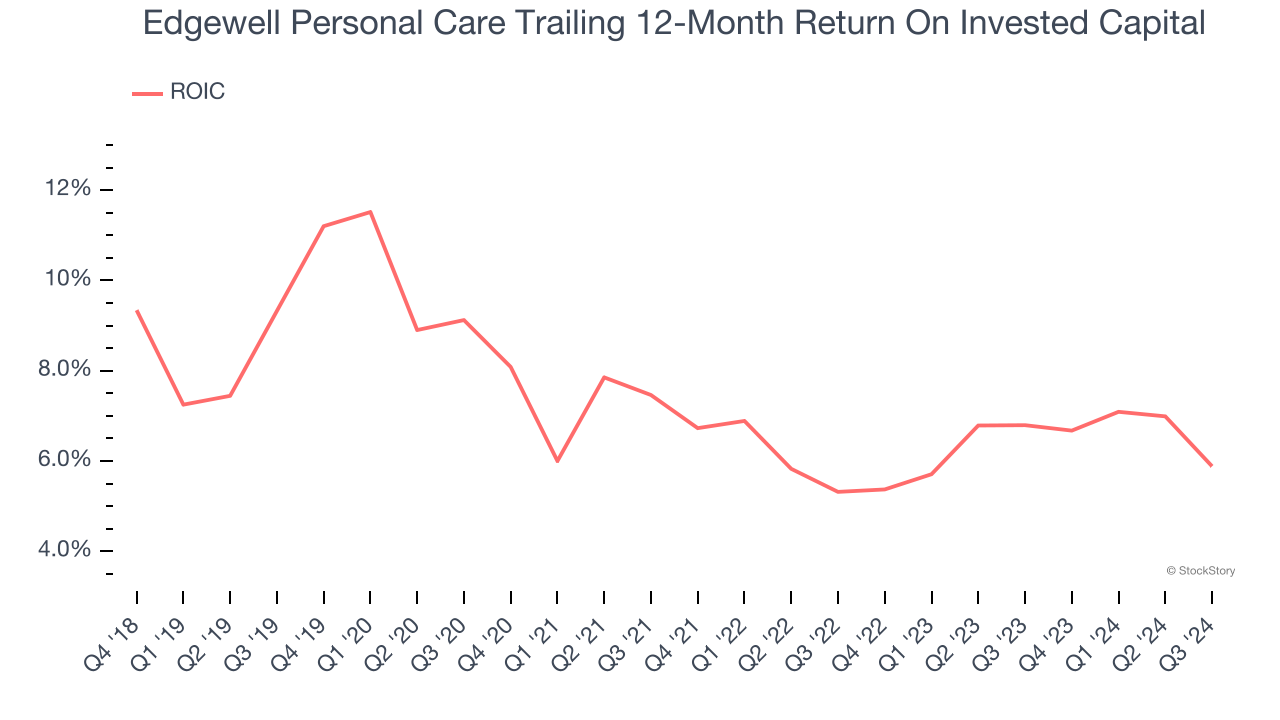

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Edgewell Personal Care historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.9%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+.

Final Judgment

Edgewell Personal Care isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 10.5× forward price-to-earnings (or $33.46 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at Cloudflare, one of our top software picks that could be a home run with edge computing.

Stocks We Like More Than Edgewell Personal Care

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.