Shopify has been on fire lately. In the past six months alone, the company’s stock price has rocketed 94.2%, reaching $112.98 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy SHOP? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Is Shopify a Good Business?

Originally created as an internal tool for a snowboarding company, Shopify (NYSE: SHOP) provides a software platform for building and operating e-commerce businesses.

1. TPV Surges as Payment Activity Increases

TPV, or total processing volume, is the aggregate dollar value of transactions flowing through Shopify’s platform. This is the number from which the company will ultimately collect fees, and the higher it is, the more chances Shopify has to upsell additional services (like banking).

Shopify’s TPV punched in at $43 billion in Q3, and over the last four quarters, its growth averaged 31.1% year-on-year increases. This performance was fantastic and shows the company is capturing significant demand on its platform. It also indicates that customers are highly active and engaged, driving higher transaction volumes and allowing Shopify to collect more in fees.

2. Customer Acquisition Costs Are Recovered in Record Time

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Shopify is extremely efficient at acquiring new customers, and its CAC payback period checked in at 6.8 months this quarter. The company’s performance indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Shopify the freedom to invest in new product initiatives while maintaining optionality.

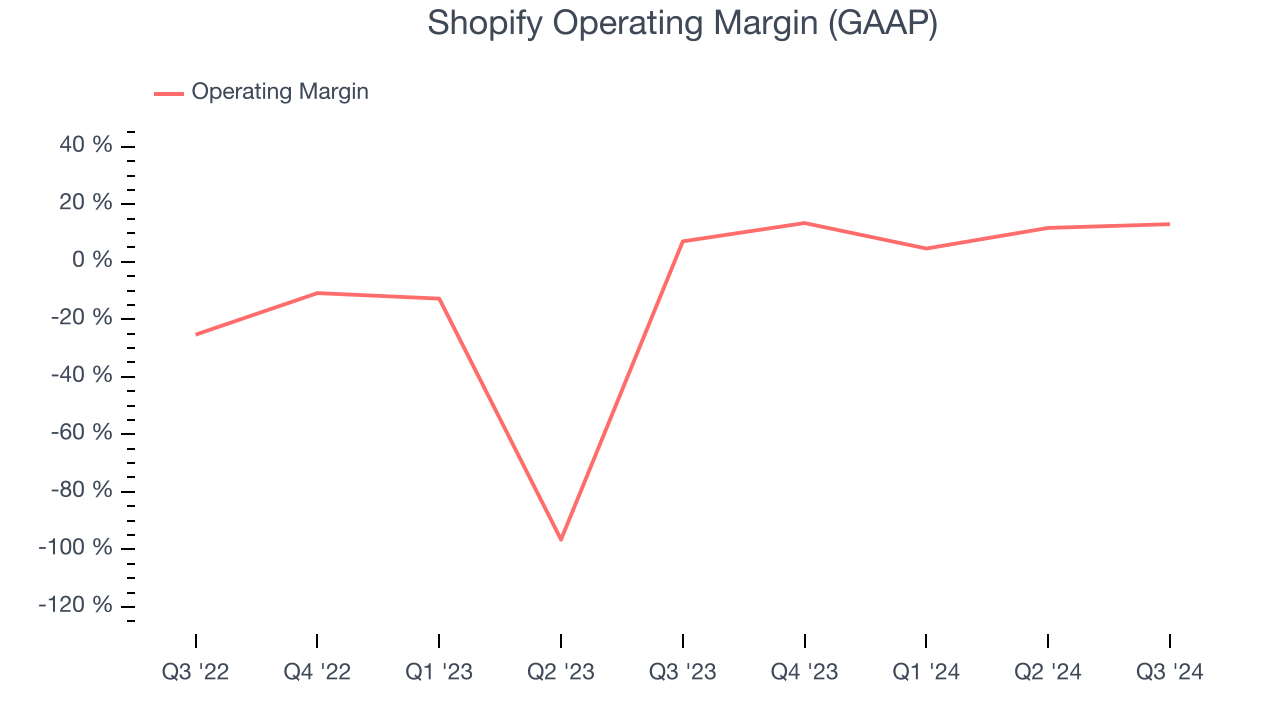

3. Operating Margin Rising, Profits Up

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Looking at the trend in its profitability, Shopify’s operating margin rose by 39.5 percentage points over the last year, as its sales growth gave it immense operating leverage. Its operating margin for the trailing 12 months was 10.9%.

Final Judgment

These are just a few reasons why we're bullish on Shopify, and after the recent rally, the stock trades at 14.7x forward price-to-sales (or $112.98 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Shopify

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.