The Federal Home Loan Bank of Pittsburgh (FHLBank) announced today unaudited financial results for the second quarter and six months ended June 30, 2025.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250723561435/en/

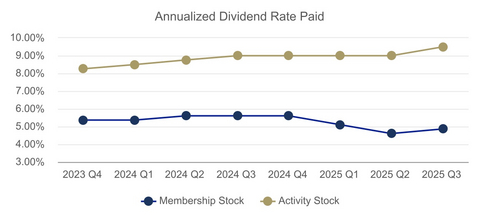

This table presents the annualized dividend rate paid over eight quarters, including the dividend to be paid July 25, 2025; these dividends are based on stockholders' average balances for the previous quarter.

Financial Highlights:

- Second quarter net income of $111.7 million

- Second quarter net interest income of $167.8 million

- Declared a second quarter dividend on activity stock at 9.50% annualized

- Declared a second quarter dividend on membership stock at 4.85% annualized

Credit Product Balances:

- Advances at $52.5 billion

- Mortgage loans held for portfolio, net at $5.1 billion

- Standby letters of credit at $28.1 billion

Community Product Assessment and Contributions:

- Statutory Affordable Housing Program (AHP) second quarter assessment of $12.5 million for use in 2026

- Second quarter voluntary contributions of $10.5 million to community investment products and a supplemental voluntary contribution to AHP of $1.3 million

Statements of Income

FHLBank’s net income totaled $111.7 million for the second quarter of 2025, compared to $149.2 million for the second quarter of 2024. The $37.5 million decrease in net income was driven primarily by the following:

-

Net interest income was $167.8 million for the second quarter of 2025, a decrease of $29.3 million from $197.1 million during the same prior-year period.

- Interest income was $1,115.8 million for the second quarter of 2025, compared to $1,516.1 million in the same prior-year period. This decrease was driven by lower short-term interest rates and lower average advances.

- Interest expense was $948.0 million for the second quarter of 2025, compared to $1,319.0 million in the same prior-year period. This decrease was the result of lower short-term interest rates and lower average consolidated obligations.

- Noninterest income (loss) was $1.5 million for the second quarter of 2025, compared to $10.5 million in the same prior-year period. This $9.0 million decrease was due primarily to valuation changes in FHLBank’s derivative and trading securities portfolios resulting from interest rate volatility.

- Other expense was $32.6 million for the second quarter of 2025, compared to $30.9 million in the same prior-year period, an increase of $1.7 million. This increase was primarily driven by higher compensation and benefits, including higher non-qualified benefit plan expense.

- Voluntary contributions to community investment products were $11.8 million, including a supplemental voluntary contribution to AHP of $1.3 million, for the second quarter of 2025, an increase of $1.6 million compared to $10.2 million in the same prior-year period. FHLBank will continue to make voluntary contributions of at least 5% of the prior year's pre-assessment net income to voluntary community investment products, a commitment target of $35.3 million. In addition, FHLBank will continue to make a supplemental voluntary contribution to AHP to increase the pool of available AHP funds to the amount that would have been statutorily required, absent FHLBank’s voluntary contributions.

- Statutory AHP assessments were $12.5 million as a result of second quarter 2025 earnings, compared to $16.6 million in the same prior-year period.

FHLBank’s net income totaled $231.8 million for the six months ended June 30, 2025, compared to $303.2 million for the same prior-year period. The $71.4 million decrease in net income was driven primarily by the following:

-

Net interest income was $340.0 million for the six months ended June 30, 2025, a decrease of $52.8 million from $392.8 million during the same prior-year period.

- Interest income was $2,313.9 million for the six months ended June 30, 2025, compared to $3,055.2 million in the same prior-year period. This decrease was driven by lower short-term interest rates and lower average advances.

- Interest expense was $1,973.9 million for the six months ended June 30, 2025, compared to $2,662.4 million in the same prior-year period. This decrease was the result of lower short-term interest rates and lower average consolidated obligations.

- Noninterest income was $1.4 million for the six months ended June 30, 2025, compared to $25.4 million in the same prior-year period. This $24.0 million decrease was due primarily to valuation changes in FHLBank’s derivative and trading securities portfolios resulting from interest rate volatility.

- Other expense was $63.5 million for the six months ended June 30, 2025, compared to $62.1 million in the same prior-year period, an increase of $1.4 million. This increase was primarily driven by higher compensation and benefits, including non-qualified benefit plan expense.

- Voluntary contributions to community investment products were $18.8 million, including a supplemental voluntary contribution to AHP of $2.0 million, for the six months ended June 30, 2025, an increase of $1.7 million compared to $17.1 million in the same prior-year period. FHLBank will continue to make voluntary contributions of at least 5% of the prior year's pre-assessment net income to voluntary community investment products, a commitment target of $35.3 million. In addition, FHLBank will continue to make a supplemental voluntary contribution to AHP to increase the pool of available AHP funds to the amount that would have been statutorily required, absent FHLBank's voluntary contributions.

- Statutory AHP assessments were $25.8 million based on earnings for the six months ended June 30, 2025, compared to $33.8 million in the same prior-year period.

Statements of Condition

At June 30, 2025, total assets were $89.3 billion, compared with $106.9 billion at December 31, 2024. The decrease was primarily due to a decline in advances, which totaled $52.5 billion at June 30, 2025, compared to $69.9 billion at year-end 2024. Demand for advances continues to be driven by members’ liquidity management practices, which are influenced by their loan demand, deposit balances and investment activities. Although advances decreased, it is not uncommon for fluctuations in advances to be driven by changes in member needs.

Total capital at June 30, 2025, was $5.1 billion, compared to $5.6 billion at December 31, 2024, including retained earnings of $2.2 billion at June 30, 2025, compared to $2.1 billion at December 31, 2024. At June 30, 2025, FHLBank remained in compliance with all regulatory capital requirements.

Quarterly Dividends

The Board of Directors declared a dividend on subclass B1 (membership) stock equal to an annual yield of 4.85% and a dividend on subclass B2 (activity) stock equal to an annual yield of 9.50%. These dividends will be calculated on stockholders’ average balances during the period April 1, 2025, to June 30, 2025, and be credited to stockholders’ accounts on July 25, 2025.

Looking forward, market, geopolitical, and business conditions can impact FHLBank’s overall performance, as well as the levels of future dividends. FHLBank’s intent is to continue to provide meaningful shareholder return; future dividend rates may not correspond directly with the pace or direction of interest rate changes.

Detailed financial information regarding second quarter and six months ended June 30, 2025, financial results will be available in FHLBank’s Quarterly Report on Form 10-Q, which FHLBank anticipates filing no later than August 12, 2025.

About FHLBank Pittsburgh

FHLBank Pittsburgh provides reliable funding and liquidity to its member financial institutions, which include commercial and savings banks, community development financial institutions, credit unions and insurance companies in Delaware, Pennsylvania and West Virginia. FHLBank products and resources help support community lending, housing and economic development. As one of 11 Federal Home Loan Banks established by Congress, FHLBank has been an integral and reliable part of the financial system since 1932. Learn more by visiting www.fhlb-pgh.com.

This document contains “forward-looking statements” - that is, statements related to future, not past, events. In this context, forward-looking statements often address FHLBank’s expected future business and financial performance, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek” or “will.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain and involve risk.

Actual performance or events may differ materially from that expected or implied in forward-looking statements because of many factors. Such factors may include, but are not limited to, economic and market conditions including but not limited to real estate, credit and mortgage markets; volatility of market prices, rates and indices related to financial instruments including but not limited to investments and contracts; the occurrence of man-made or natural disasters, endemics, global pandemics, climate change, conflicts or terrorist attacks, or other geopolitical events; political events, including legislative, regulatory, litigation, or judicial events or actions, including those relating to environmental, social, and governance matters; risks related to mortgage-backed securities (MBS); changes in the assumptions used to estimate credit losses; changes in FHLBank’s capital structure; changes in FHLBank’s capital requirements; changes in expectations regarding FHLBank’s payment of dividends; membership changes; changes in the demand by FHLBank members for FHLBank advances; an increase in advance prepayments; competitive forces, including the availability of other sources of funding for FHLBank members; changes in investor demand for consolidated obligations and/or the terms of interest rate exchange agreements and similar agreements; disruptions in the capital markets; changes in the Federal Home Loan Bank System’s debt rating or FHLBank’s rating; the ability of FHLBank to introduce new products and services to meet market demand and to manage successfully the risks associated with new products and services; the ability of each of the other Federal Home Loan Banks to repay the principal and interest on consolidated obligations for which it is the primary obligor and with respect to which FHLBank has joint and several liability; applicable FHLBank policy requirements for retained earnings and the ratio of the market value of equity to par value of capital stock; FHLBank’s ability to maintain adequate capital levels (including meeting applicable regulatory capital requirements); business and capital plan adjustments and amendments; technology and cybersecurity risks; and timing and volume of market activity. Additional risks that might cause FHLBank’s results to differ from these forward-looking statements are provided in detail in FHLBank’s filings with the Securities and Exchange Commission, which are available at www.sec.gov. Forward-looking statements speak only as of the date made and FHLBank has no obligation, and does not undertake publicly, to update or revise any forward-looking statement for any reason.

Unaudited Condensed Statements of Condition and Income (in millions) |

||||||||

Condensed Statement of Condition |

|

June 30, 2025 |

|

December 31, 2024 |

||||

ASSETS: |

|

|

|

|

||||

Cash and due from banks |

|

$ |

19.9 |

|

|

$ |

17.3 |

|

Investments |

|

|

30,944.9 |

|

|

|

31,282.4 |

|

Advances |

|

|

52,487.7 |

|

|

|

69,873.2 |

|

Mortgage loans held for portfolio, net |

|

|

5,065.9 |

|

|

|

4,816.5 |

|

All other assets |

|

|

800.9 |

|

|

|

937.3 |

|

Total assets |

|

$ |

89,319.3 |

|

|

$ |

106,926.7 |

|

|

|

|

|

|

||||

LIABILITIES: |

|

|

|

|

||||

Consolidated obligations |

|

$ |

82,804.9 |

|

|

$ |

99,650.3 |

|

All other liabilities |

|

|

1,453.2 |

|

|

|

1,642.3 |

|

Total liabilities |

|

|

84,258.1 |

|

|

|

101,292.6 |

|

|

|

|

|

|

||||

CAPITAL: |

|

|

|

|

||||

Capital stock |

|

$ |

2,931.2 |

|

|

$ |

3,561.7 |

|

Retained earnings |

|

|

2,184.9 |

|

|

|

2,102.9 |

|

Accumulated other comprehensive income (loss) |

|

|

(54.9 |

) |

|

|

(30.5 |

) |

Total capital |

|

|

5,061.2 |

|

|

|

5,634.1 |

|

Total liabilities and capital |

|

$ |

89,319.3 |

|

|

$ |

106,926.7 |

|

|

For the three months ended June 30, |

For the six months ended June 30, |

||||||||||

Condensed Statement of Income |

|

2025 |

|

|

2024 |

|

2025 |

|

|

2024 |

|

|

Total interest income |

$ |

1,115.8 |

|

$ |

1,516.1 |

$ |

2,313.9 |

|

$ |

3,055.2 |

|

|

Total interest expense |

|

948.0 |

|

|

1,319.0 |

|

1,973.9 |

|

|

2,662.4 |

|

|

Net interest income |

|

167.8 |

|

|

197.1 |

|

340.0 |

|

|

392.8 |

|

|

|

|

|

|

|

||||||||

Provision (reversal) for credit losses |

|

0.7 |

|

|

0.7 |

|

1.5 |

|

|

2.0 |

|

|

Gains (losses) on investments |

|

0.7 |

|

|

— |

|

3.1 |

|

|

(1.0 |

) |

|

Gains (losses) on derivatives and hedging |

|

(7.7 |

) |

|

1.5 |

|

(19.6 |

) |

|

7.3 |

|

|

Other income |

|

8.5 |

|

|

9.0 |

|

17.9 |

|

|

19.1 |

|

|

Other expense |

|

32.6 |

|

|

30.9 |

|

63.5 |

|

|

62.1 |

|

|

Voluntary contributions |

|

11.8 |

|

|

10.2 |

|

18.8 |

|

|

17.1 |

|

|

Income before assessments |

|

124.2 |

|

|

165.8 |

|

257.6 |

|

|

337.0 |

|

|

|

|

|

|

|

||||||||

AHP assessment |

|

12.5 |

|

|

16.6 |

|

25.8 |

|

|

33.8 |

|

|

Net income |

$ |

111.7 |

|

$ |

149.2 |

$ |

231.8 |

|

$ |

303.2 |

|

|

View source version on businesswire.com: https://www.businesswire.com/news/home/20250723561435/en/

Contacts

Eric M. Slomer, FHLBank Pittsburgh, 412-288-7694, eric.slomer@fhlb-pgh.com