With a market cap of $28.4 billion, Ameren Corporation (AEE) provides rate-regulated electric and natural gas services through its subsidiaries, including Ameren Missouri, Ameren Illinois Electric Distribution, Ameren Illinois Natural Gas, and Ameren Transmission. It generates electricity from a diverse mix of coal, nuclear, natural gas, and renewable sources to serve residential, commercial, and industrial customers.

Shares of the Saint Louis, Missouri-based company have lagged behind the broader market over the past 52 weeks. AEE stock has gained 8.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12.2%. However, shares of the company are up nearly 5% on a YTD basis, outpacing SPX's marginal decline.

Looking closer, shares of the utility company have underperformed the State Street Utilities Select Sector SPDR ETF's (XLU) nearly 10% return over the past 52 weeks.

Shares of Ameren recovered marginally following its Q3 2025 results on Nov. 5. The company delivered stronger-than-expected adjusted EPS of $2.17 and revenue of $2.7 billion, supported by higher infrastructure investments, new Missouri electric rates effective June 1, and stronger weather-driven demand. Investor sentiment was further supported by raised 2025 guidance, with EPS lifted to $5.08 - $5.28 and adjusted EPS to $4.90 - $5.10, alongside newly issued 2026 EPS guidance of $5.25 - $5.45.

For the fiscal year that ended in December 2025, analysts expect Ameren's adjusted EPS to grow 8.4% year-over-year to $5.02. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

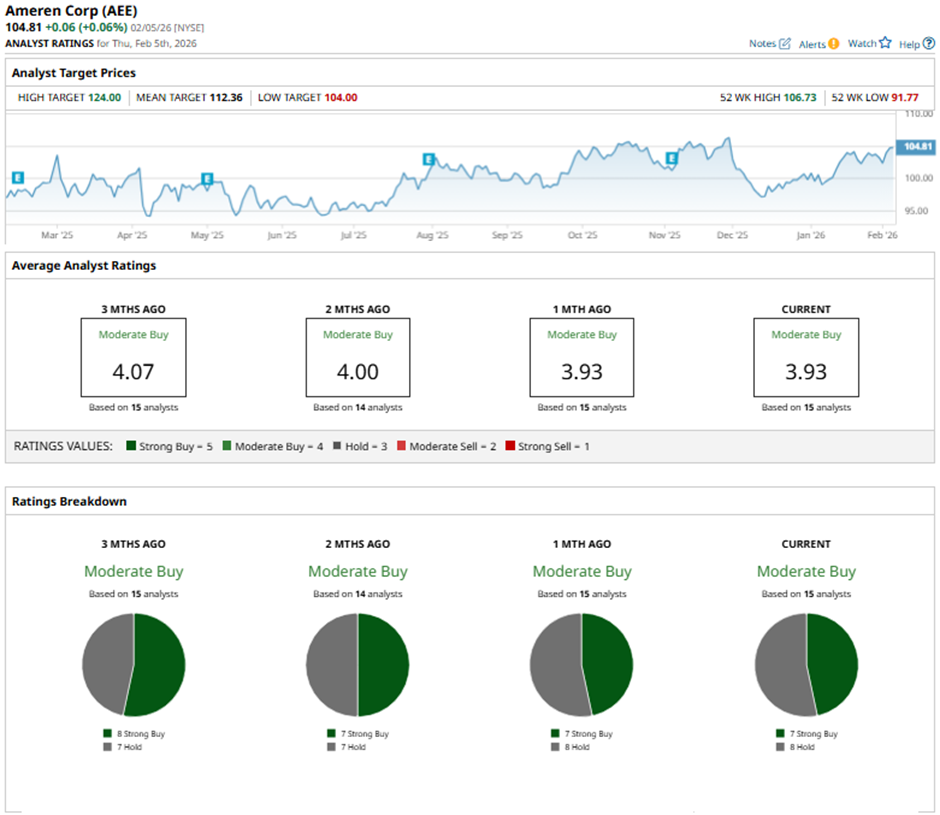

Among the 15 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings and eight “Holds.”

On Jan. 23, RBC Capital analyst Stephen D’Ambrisi cut Ameren’s price target to $116 and maintained a “Sector Perform" rating.

The mean price target of $112.36 represents a premium of 7.2% to AEE's current levels. The Street-high price target of $124 implies a potential upside of 18.3% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart