Prudential Financial, Inc. (PRU) is a leading global financial services company headquartered in Newark, New Jersey. With a market cap of $36.6 billion, the firm provides a wide range of insurance, investment management, and retirement-related products and services to individual and institutional clients across the United States, Asia, Europe, and Latin America.

PRU stock has declined 6.5% over the past 52 weeks and 7.3% on a YTD basis. In comparison, the S&P 500 Index ($SPX) has returned 11.8% over the past year and has dipped marginally in 2026.

Narrowing the focus, PRU has also lagged behind the iShares U.S. Insurance ETF’s (IAK) 3.9% rise over the past 52 weeks and its 1.2% plunge this year.

On Feb. 3, delivered fourth-quarter 2025 results, with after-tax adjusted operating income of $1.168 billion, or $3.30 per share, and net income of $905 million, or $2.55 per share, both increasing year over year. Results were supported by higher asset-management and insurance fee income and improved underwriting in certain segments, partially offset by less favorable mortality and higher expenses. However, its shares dipped 4.1% following the earnings release.

For the current year ending in December, analysts expect PRU’s EPS to increase 1.9% year over year to $14.70. Moreover, the company has surpassed analysts’ consensus estimates in three of the past four quarters, while missing on one occasion.

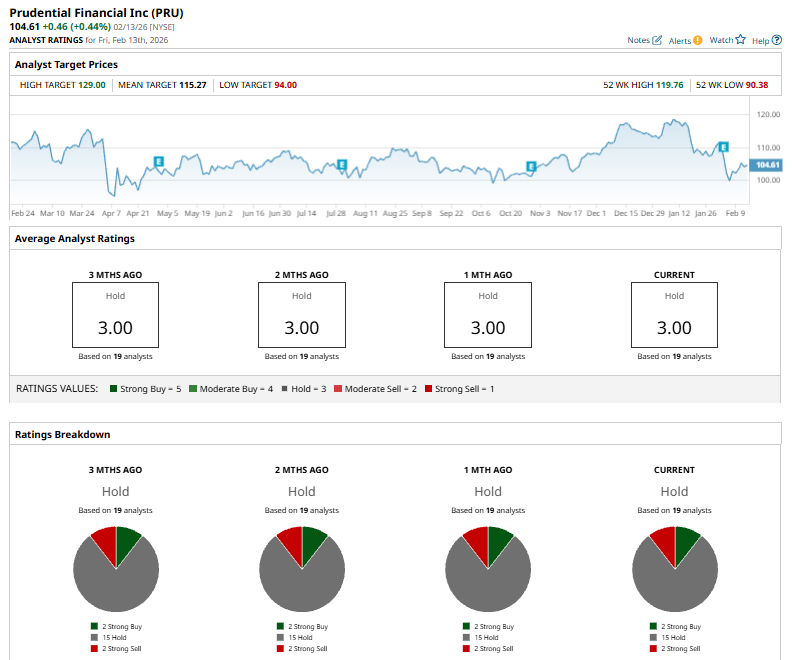

Among the 19 analysts covering the stock, the consensus rating is a “Hold.” That’s based on two “Strong Buy” ratings, 15 “Holds,” and two “Strong Sells.”

On Feb. 10, Mizuho analyst Yaron Kinar maintained a 'Neutral' rating for Prudential Financial while lowering the price target from $126 to $113.

PRU’s mean price target of $115.27 indicates a premium of 10.2% from the current market prices. Its Street-high target of $129 suggests a robust 23.3% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart