Pinterest (PINS) shares closed more than 16% lower last Friday after the visual discovery firm reported a weaker-than-expected Q4 and issued disappointing guidance for the future.

As investors reacted to an 85% year-over-year decline in net income, PINS’ relative strength index (14-day) crashed to about 16 only, indicating extremely oversold conditions.

Still, Citi analysts recommend unloading Pinterest stock that’s already now down some 45% versus its year-to-date high.

Why Did Citi Downgrade Pinterest Stock?

Pinterest blamed tariffs as it guided for up to $971 million in revenue for the current quarter, well below the $980 million that Wall Street had called for.

According to Citi analysts, higher levies are making PINS’ key customers across home furnishings and décor verticals pull back on their advertising budgets this year.

Pinterest has to make sizable investments to broaden its advertiser base but that will “pressure” margins in the near term, they added.

Citi downgraded PINS stock to “Neutral” after the company’s quarterly release and slashed its price target in half to $19. Note that the social media platform doesn’t currently pay a dividend either.

Are PINS Shares Worth Buying Today?

Citi “cautions against buying the post-earnings dip” in Pinterest shares due to artificial intelligence (AI) disruption fears as well.

Mega-cap tech names like Google (GOOGL) and Meta Platforms (META) have started integrating advanced shopping tools into their chatbots and search engine, while OpenAI’s latest ad solutions are gaining traction with advertisers as well.

In the long run, this potential shift in market dynamics could hurt Pinterest’s value proposition and make it difficult for its share price to stage a comeback in 2026, the investment firm told its clients.

Even from a technical perspective, PINS now sits handily below its major moving averages (MAs), indicating bears are firmly in control across multiple timeframes.

What’s the Consensus Rating on Pinterest?

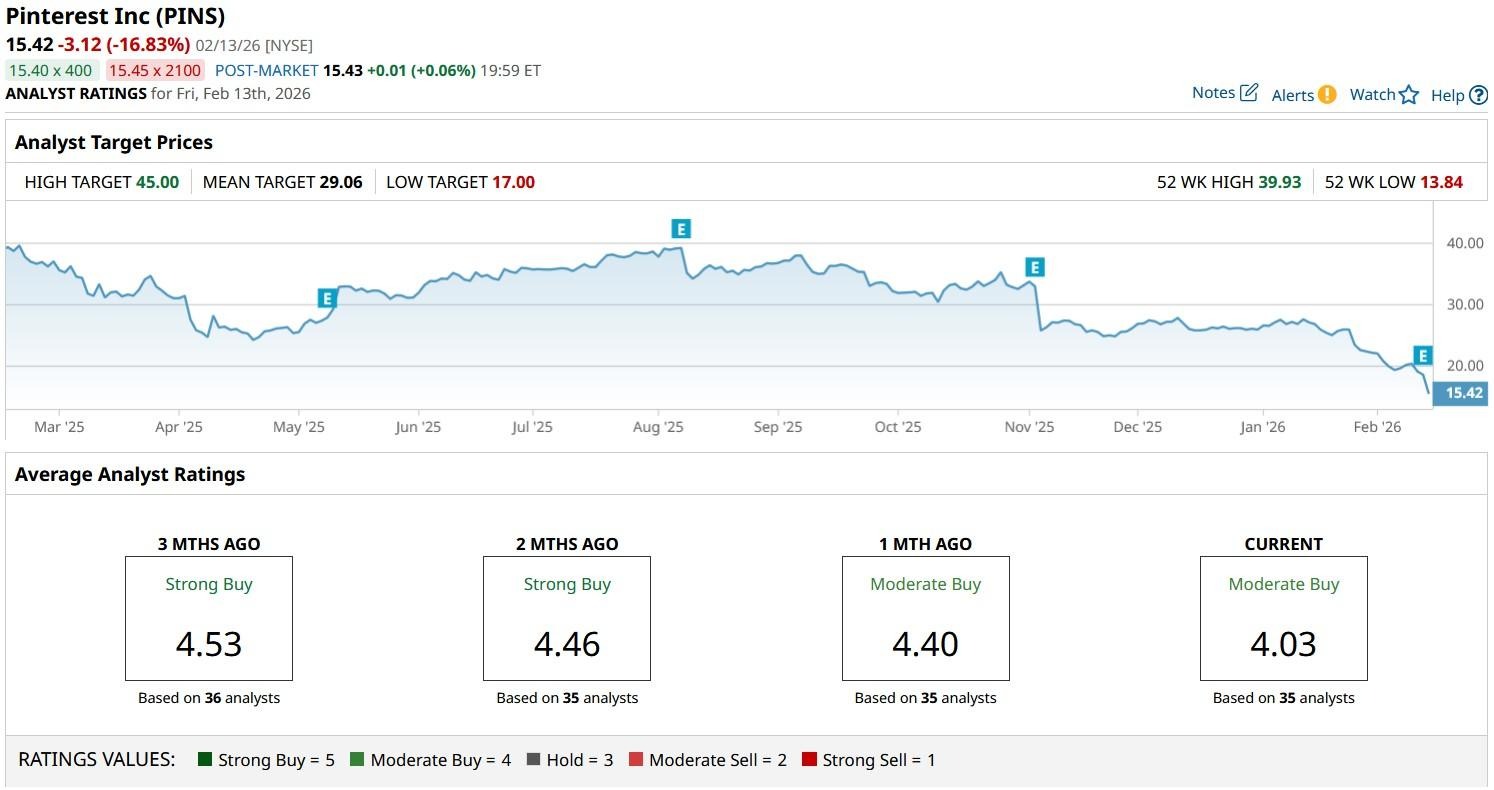

Heading into the earnings release, Wall Street had a consensus “Moderate Buy” rating on Pinterest with a mean target of about $29.

Following the disappointing quarterly update, however, some of them could choose to downwardly revise estimates for PINS shares, further muting the possibility of a swift recovery.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart