Ray Wang, the founder of technology research and advisory firm Constellation Research, believes that enough is enough with the selloff in tech stocks. After a stellar 2025, when artificial intelligence (AI) and the companies associated with the revolutionary tech were celebrated, 2026 has suddenly seen a turnaround as skeptics gawk at the capital expenditures that hyperscalers have earmarked for this year.

While tthe biggest exchange-traded fund (ETF) covering the “Magnificant Seven” stocks — the Roundhill Magnificent Seven ETF (MAGS) — is down 7% so far this year, the iShares Expanded Tech-Software Sector ETF (IGV) has seen an even sharper downturn of 22% in 2026.

Wang reckons that tech is set for a comeback soon, however. “When they have nothing to invest in, where there’s nothing growing in the 30% range, they’re probably going to come back and say, we’ve got to get back into tech,” said the veteran tech analyst.

Notably, Wang is particularly bullish about the following three names. Let's take a closer look.

Tech Stock #1: Cisco Systems (CSCO)

Founded in 1984, Cisco Systems (CSCO) is a global provider of networking, security, observability, collaboration, and infrastructure software. Its core businesses include enterprise switches and routers, cloud networking, cybersecurity platforms, observability tools, and collaboration software such as Webex. The company’s products are embedded deeply across enterprise IT environments, service providers, and government networks, creating high switching costs and recurring service revenues.

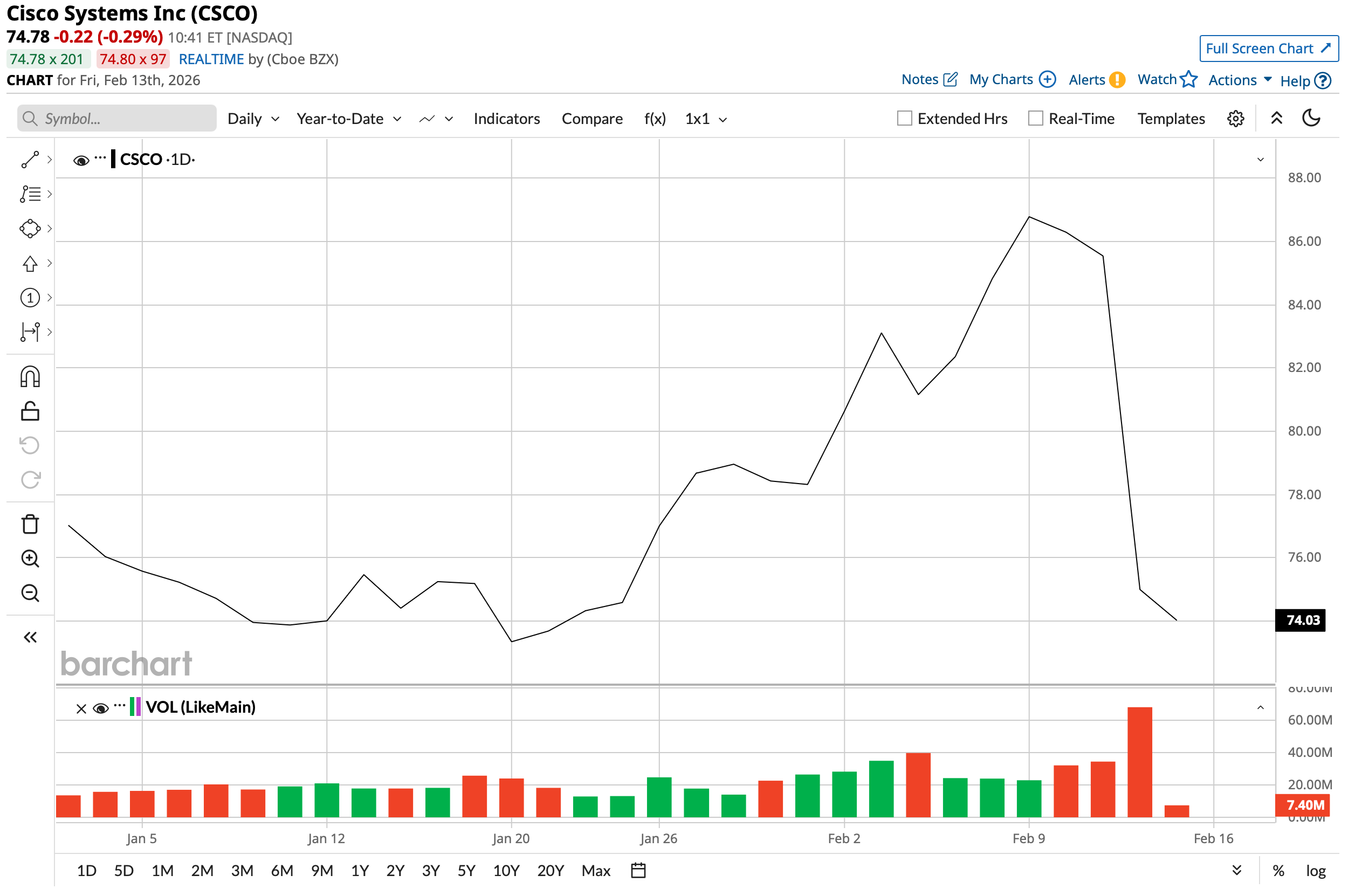

Valued at a market capitalization of $303 billion, CSCO stock is down just 0.2% on a year-to-date (YTD) basis. The stock also offers a dividend yield of 2.19%.

Meanwhile, results for the most recent quarter saw the company reporting record revenues and earnings surpassing Street estimates. While revenues of $15.3 billion for the second quarter marked growth of 10% year-over-year (YOY), EPS went up by 11% YOY to $1.04. With that, EPS recorde yet another consecutive quarter of beating estimates.

Although remaining performance obligations saw YOY growth of 5% to $43.4 billion, net cash flow from operating activities declined 19% YOY to $1.8 billion. Overall, Cisco ended fiscal Q2 2026 with a cash balance of $7.46 billion, lower than its short-term debt levels of $8.72 billion.

Wang remains particularly convinced about the company's new G300 chip. The analyst believes it can compete effectively with chips coming from the likes of Broadcom (AVGO) and Nvidia (NVDA).

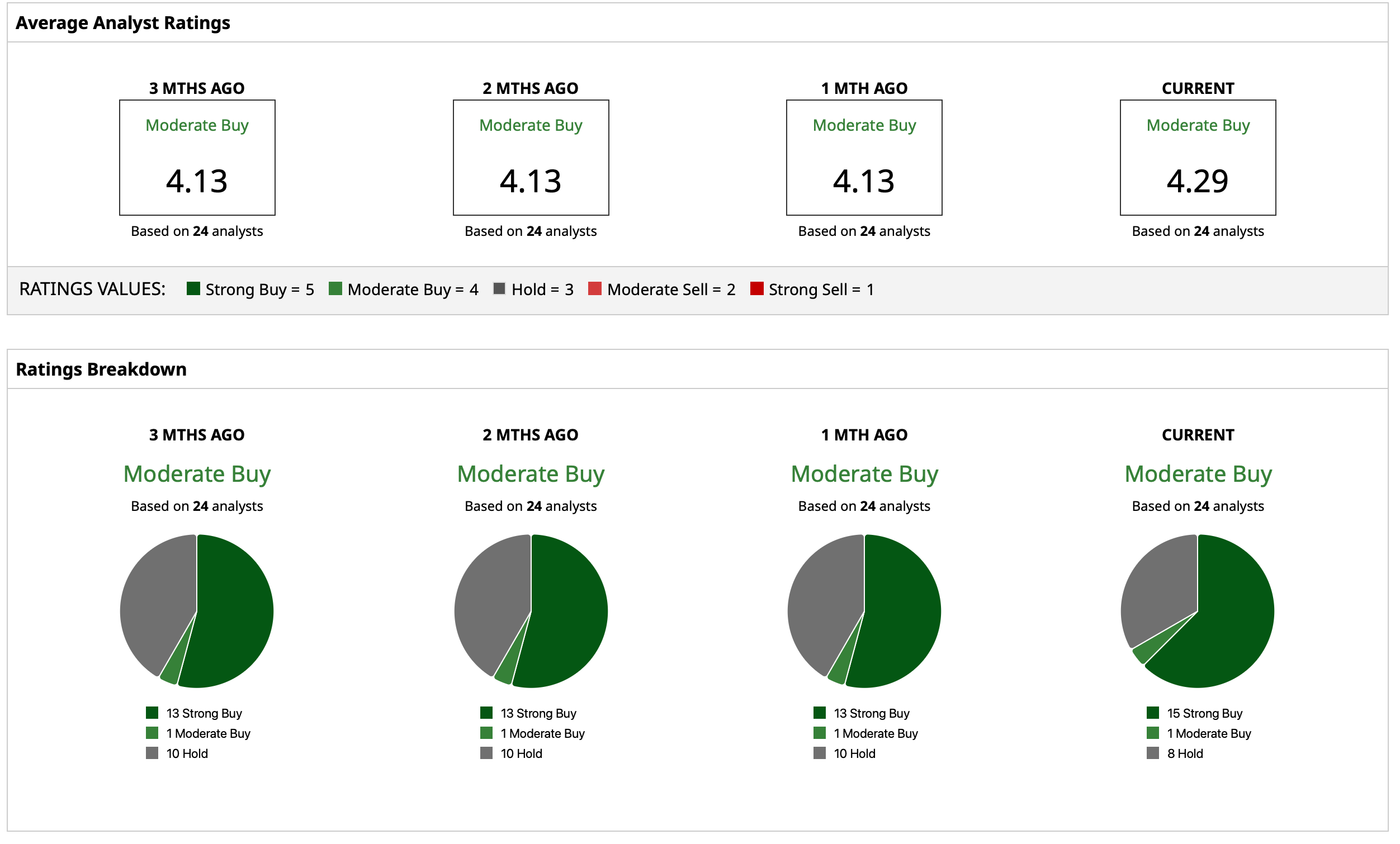

Overall, analysts remain cautiously optimistic about CSCO stock with a “Moderate Buy" consensus rating. The mean target price of $88.30 reflects potential upside of 15% from current levels. Out of 24 analysts covering the stock, 15 have a “Strong Buy” rating, one has a “Moderate Buy” rating, and eight have a “Hold” rating.

Tech Stock #2: Nvidia (NVDA)

The world's most valuable company, Nvidia reached that status by making the most critical component of the AI revolution: the chips. Founded in 1993, the firm pioneered the modern graphics processing unit (GPU) category. Now, Nvidia designs accelerated computing platforms spanning GPUs, AI systems, networking hardware, software frameworks, and complete data-center solutions. The company’s business is dominated by AI and data-center infrastructure, where its GPUs are used for training and inference of large language models and other AI workloads.

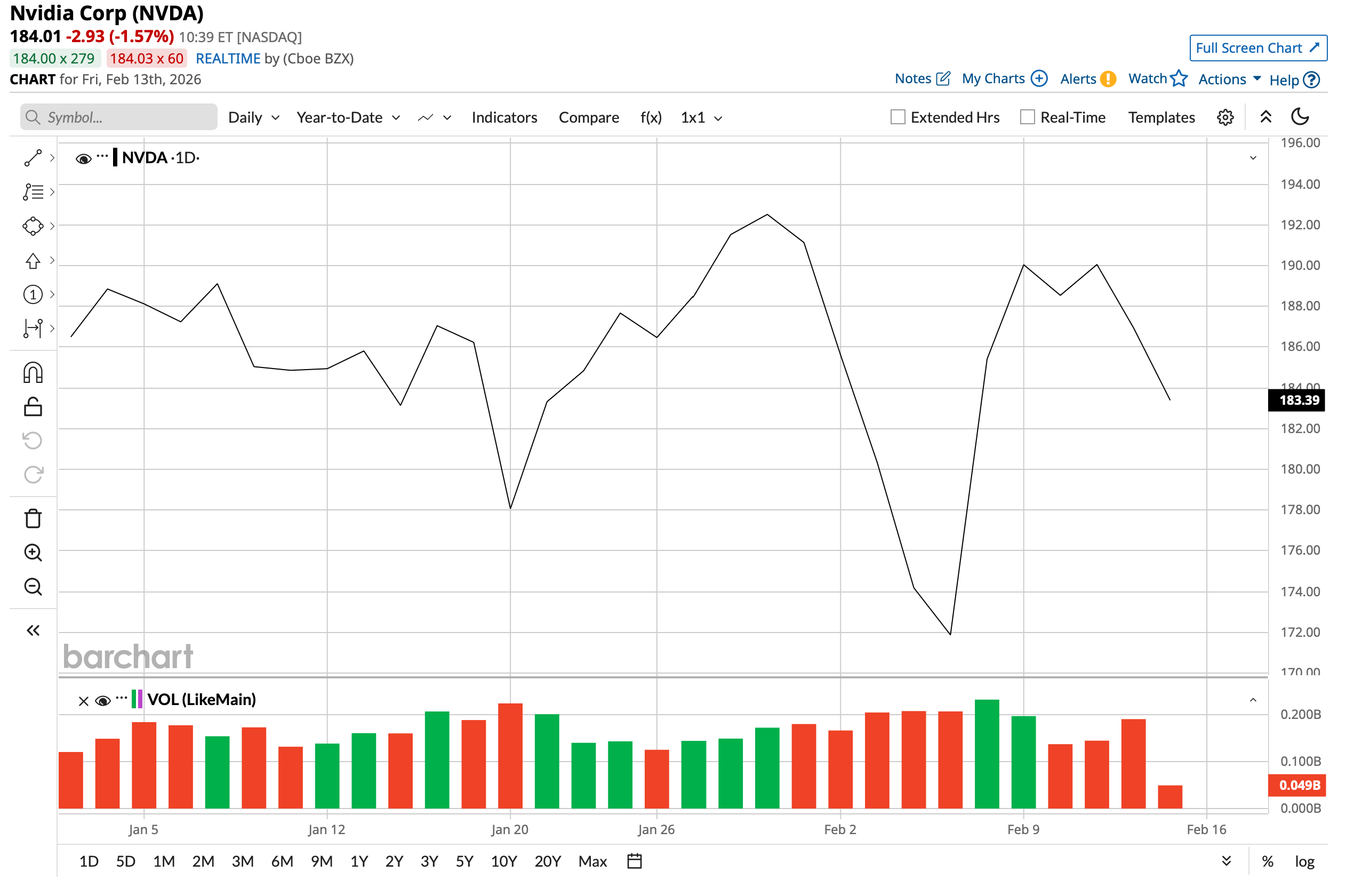

Nvidia is valued at a market cap of $4.44 trillion, while NVDA stock is down 2% on a YTD basis.

Nvidia turned in yet another impressive quarter in Q3 fiscal 2026, clearing both revenue and earnings expectations while keeping YOY growth well above 50% on each line. Sales for the quarter reached $57 billion, marking a 62% increase from the year-ago period. EPS rose 60% to $1.30, coming in ahead of the $1.26 consensus figure. The data center business — still the primary growth engine — expanded 66% YOY to $51.2 billion.

Cash flow stayed exceptionally strong. Operating cash flow climbed to $23.8 billion from $17.6 billion a year earlier, and free cash flow jumped 64% to $22.1 billion. The company finished the period with $60.6 billion in cash on hand, short-term debt under $1 billion, and long-term debt at $7.5 billion.

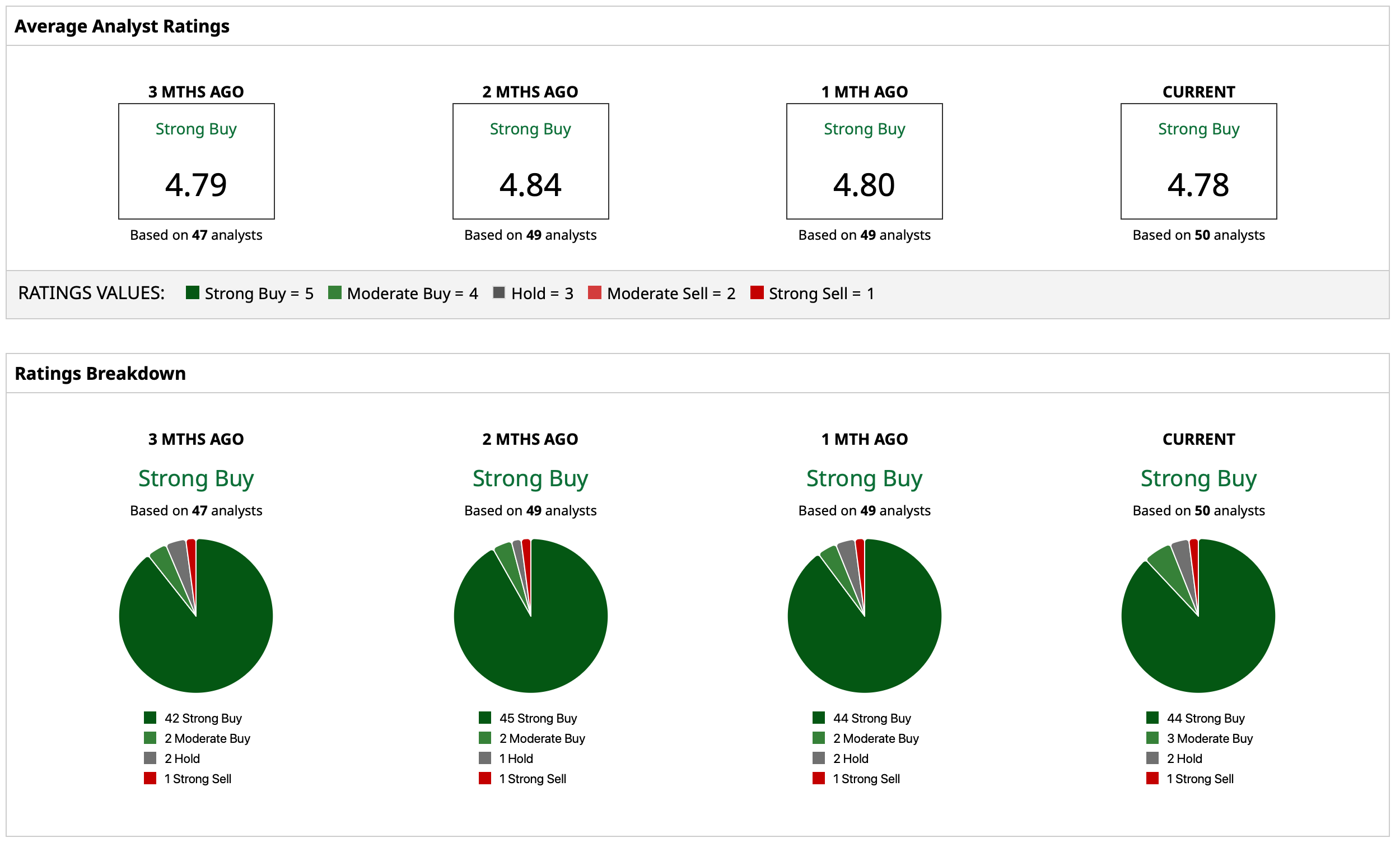

Analysts have a consensus rating of “Strong Buy” for NVDA stock, with a mean target price of $255.55. This indicates potential upside of about 40% from current levels. Out of 50 analysts covering the stock, 44 have a “Strong Buy” rating, three have a “Moderate Buy” rating, two have a “Hold” rating, and one has a “Strong Sell” rating.

Tech Stock #3: Taiwan Semiconductor (TSM)

Shifting focus from a designer of chips to one of the world's top chip manufacturers, we have Taiwan Semiconductor (TSM). Founded in 1987, TSMC pioneered what became the industry-defining pure-play foundry model, which involves manufacturing chips designed by others rather than competing as an integrated chip designer. Taiwan Semiconductor manufactures chips for hundreds of global customers across smartphones, high-performance computing, AI, automotive, and IoT markets. In 2025, the company served more than 500 customers and manufactured thousands of products across advanced nodes and specialty technologies, operating multiple giga-fabs in Taiwan alongside expanding capacity in the U.S., Japan, and Europe.

Valued at a market cap of $1.89 trillion, TSM stock is up 21% on a YTD basis, while also offering a modest dividend yield of 0.68%.

Notably, TSMC reported a beat on both the revenue and earnings front for its latest quarterly results. Q4 2025 saw the company's revenues surge by nearly 26% from the previous year to $33.73 billion. Meanwhile, earnings went up by 35% in the same period to $3.14 per share. Impressively, over the past nine quarters, the company's earnings have missed estimates on just one instance.

In 2025, TSMC's net cash from operating activities stood at $73.11 billion, up 29% from the previous year. Overall, the company ended 2025 with a cash balance of about $88 billion, much higher than its short-term debt levels of $4.36 billion.

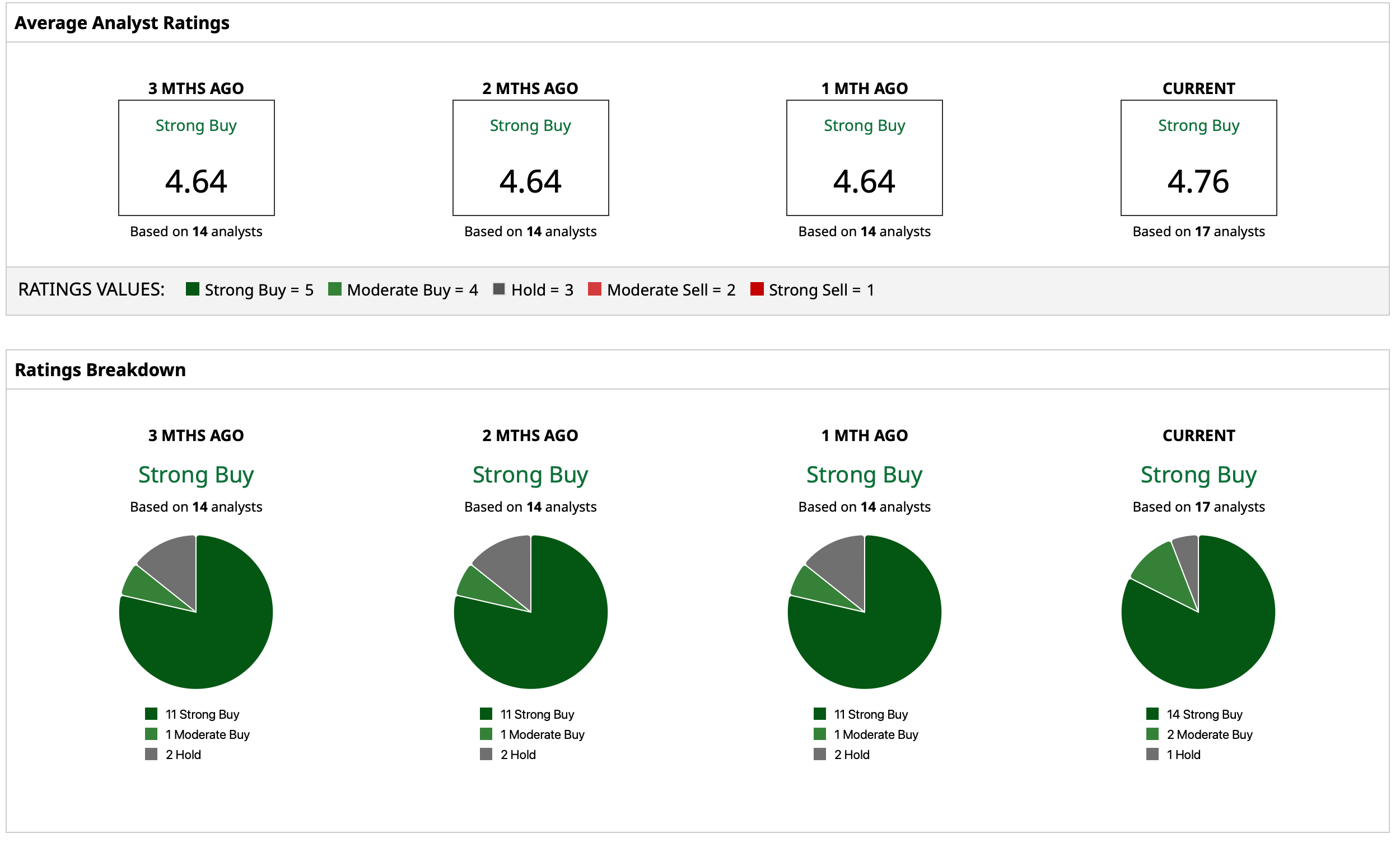

Analysts have a “Strong Buy” consensus rating for TSM stock, with a mean target price of $411.23. This indicates potential upside of about 12% from current levels. Out of 18 analysts covering the stock, 15 have a “Strong Buy” rating, two have a “Moderate Buy” rating, and one has a “Hold” rating.

The Bottom Line

The primary skepticism about the AI trade currently is around return on investment (ROI) — whether these companies' huge investments are warranted and whether they will accrue a decent enough return to justify the huge spend. However, the utility and the efficiency gains that AI will bring about are indisputable and inevitable, although it may take some time. Considering that, one of the best ways to benefit can be through these names preferred by Wang. While Nvidia and TSMC are proven performers and crucial to the AI trade, Cisco is finally shaking off its inertness and looking to make a serious splash as well.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- AI Stocks Are in Trouble: Is This Just a Pullback or the Start of a Bear Market?

- As This Hedge Fund Sells NVDA , GOOGL, and META, Here Is 1 Blue-Chip Stock It’s Loading Up On

- DraftKings Stock Is Oversold on Earnings Plunge. Should You Buy the Dip?

- As Coinbase Stock Rallies Nearly 20%, Should You Chase COIN Higher?