Selling put options before a company's earnings announcement can be a valid strategy for options traders seeking to capitalize on higher than normal volatility.

One of the primary reasons traders may consider selling a Occidental Petroleum (OXY) put option before their earnings announcement on next week is the elevated implied volatility. Earnings reports can trigger significant price movements, and this volatility results in an increase in option premiums. By selling the put option before the announcement, traders aim to capitalize on the inflated premium, especially if they believe that the stock will remain above the strike price by the option's expiration date.

Before delving into the strategy, let's quickly recap what it means to sell a put option. A cash-secured put involves writing an at-the-money or out-of-the-money put option and simultaneously setting aside enough cash to buy the stock. The goal is to either have the put expire worthless and keep the premium or be assigned and acquire the stock below the current price.

Selling put options is an easy place for investors to start with options. They are like a covered call and are pretty easy to understand once you know the basics.

Traders selling puts should understand that they may be assigned 100 shares at the strike price.

Potential Benefits

Selling put options allows traders to collect premium income upfront. If the options expire worthless, the seller keeps the entire premium as profit.

The premium received can lower the breakeven point for the trade. If the stock price drops but remains above the breakeven point, the seller still profits.

Traders who are bullish or neutral on OXY can benefit from the increased volatility leading up to the earnings report.

After the earnings announcement, implied volatility tends to drop significantly, reducing option premiums. By selling options before the announcement, traders can take advantage of this implied volatility drop.

Potential Risks

If the stock price falls below the put option's strike price, the seller may be obligated to buy OXY shares at a higher price than the current market value.

While the profit potential is limited to the premium received, losses can theoretically be unlimited if the stock price drops significantly.

An earnings surprises could result in a sharp drop in the price of OXY stock.

Selling an OXY Put Option Before Earnings

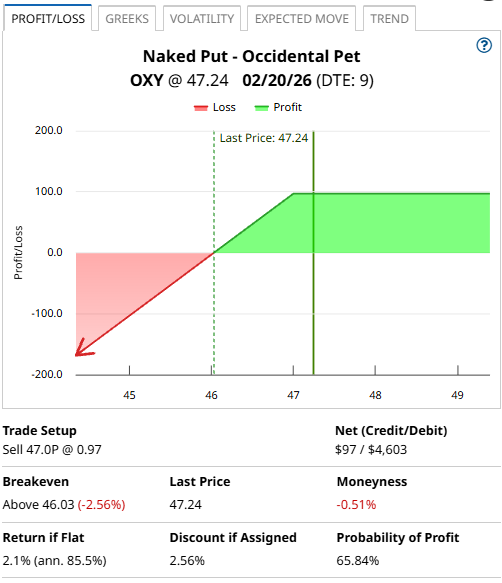

A trader selling the February 20 $47-strike put on OXY would receive around $97 into their account, which would be theirs to keep.

If OXY falls below $47 by February 20, they would be required to buy 100 shares at $47. The effective net cost of the position would be $46.03, thanks to the option premium received.

That is 2.56% below Wednesday’s closing price.

If the stock stays above $47 at expiry, the put expires worthless, leaving the trader with a 2.1% return on capital at risk.

That works out to be 85.5% annualized.

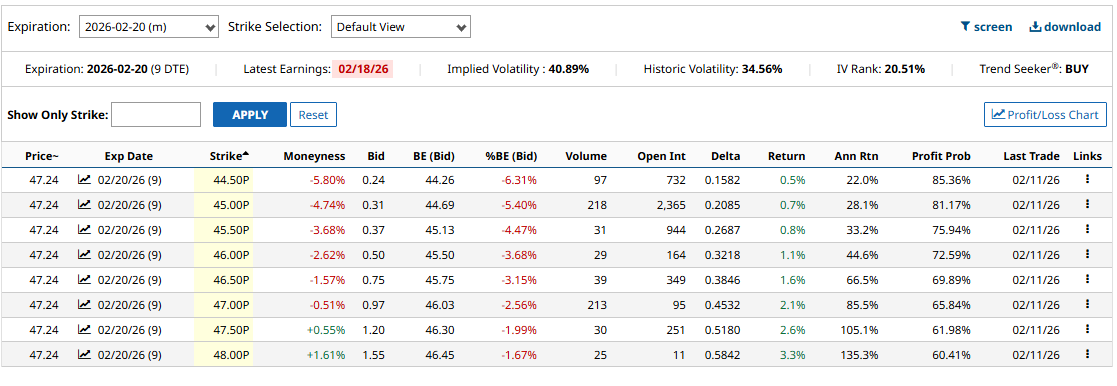

This table shows other potential put selling candidates on Occidental Petroleum for the February 20 expiration.

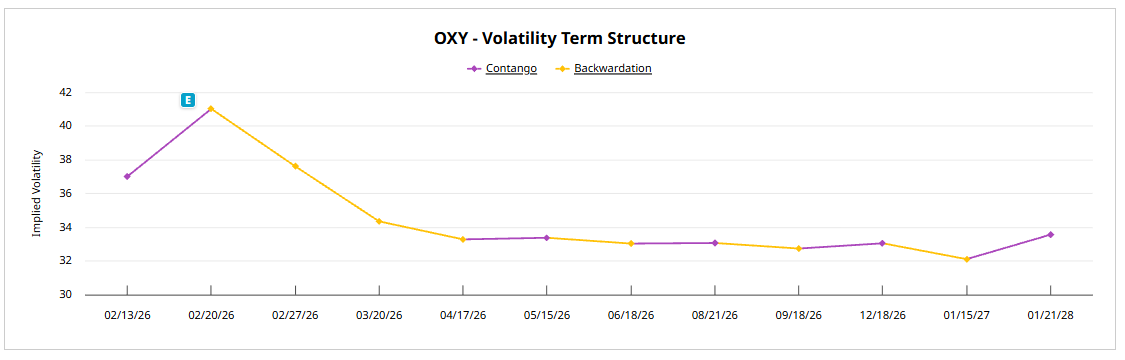

On the Occidental Petroleum volatility charts, we can see the term structure shows that implied volatility is very high for the expiration immediately after earnings.

This 41.1% volatility means high option premiums when compared to longer-term options which only have volatility of around 33%.

Company Details

The Barchart Technical Opinion rating is a 40% Buy with a Strengthening short term outlook on maintaining the current direction.

Occidental Petroleum Corporation is an international energy company with assets primarily in the United States, the Middle East and North Africa.

Its operating segment includes oil and gas, chemical and midstream and marketing. Occidental Petroleum Corporation is based in HOUSTON, United States.

Of the 26 analysts covering Occidental Petroleum, 4 have a Strong Buy, 1 has a Moderate Buy rating, 16 have a Hold rating and 5 have a Strong Sell rating.

Conclusion

Selling a Occidental Petroleum put option before their earnings announcement is a strategy that can potentially generate income while taking advantage of heightened volatility. However, it's essential to understand the risks involved, including the possibility of assignment and unlimited losses.

Conservative investors may consider buying a further out-of-the-money put to reduce the risk and capital requirements.

This essentially turns the trade into a bull put spread.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 1 Under-the-Radar Quantum Computing Stock to Buy Now for a Major NASA Deal

- OXY Earnings Play: Using Puts to Get Paid While You Wait

- Stocks Rise Before the Open on U.S. Economic Optimism, Earnings and Jobless Claims Data in Focus

- This Outperforming Dividend Stock Increased Its 2026 Payout by 20%: Should You Buy?