When BlackRock (BLK) makes a move, markets pay attention. The $14 trillion fund manager just raised its stake in gold and platinum miner Sibanye-Stillwater (SBSW) to over 5%, crossing a disclosure threshold that reveals serious institutional interest.

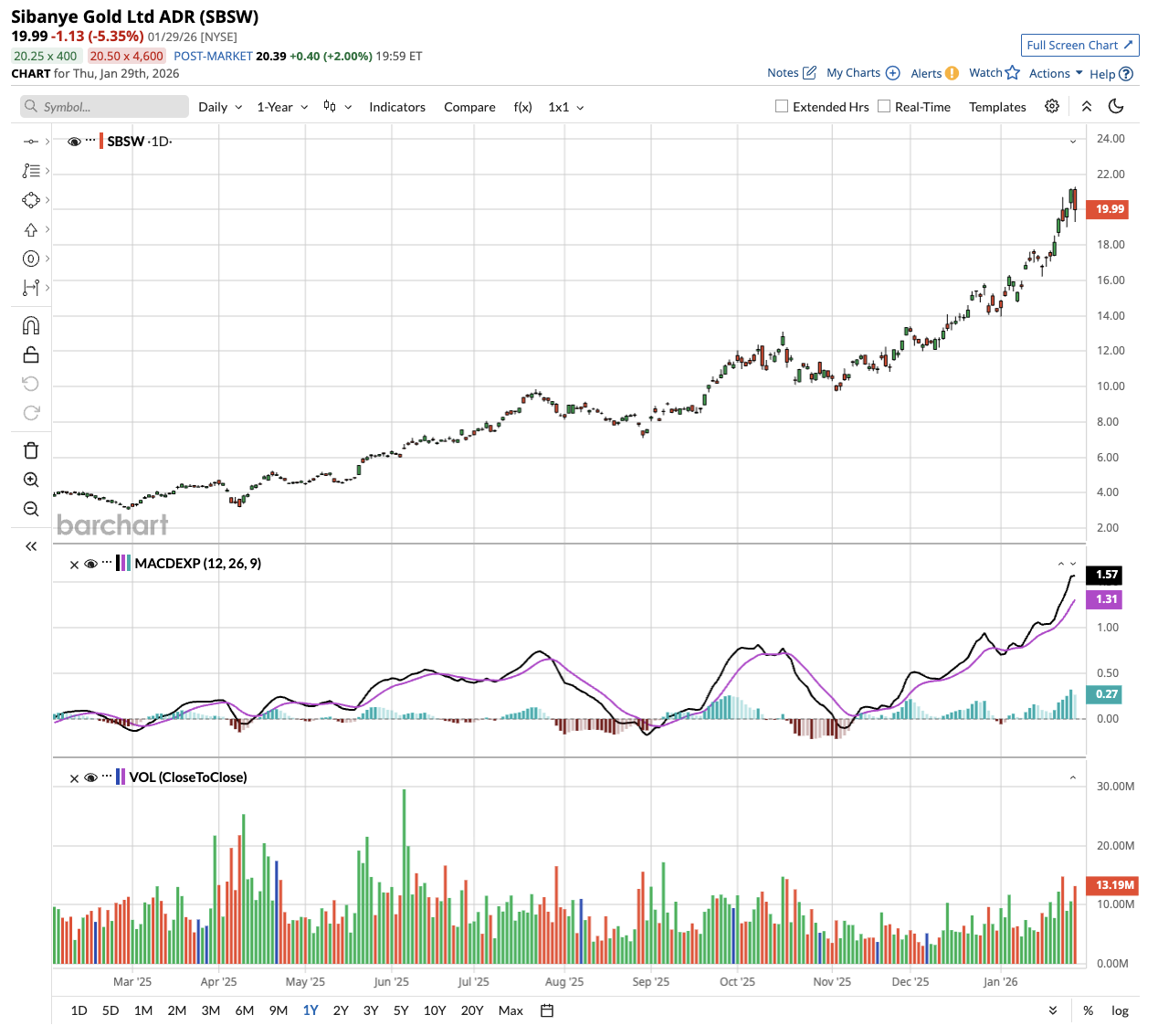

Valued at a market cap of $14.7 billion, Sibanye-Stillwater has returned 380% to shareholders over the last 12 months. In fact, SBSW stock has roughly doubled in the last six months.

A Perfect Storm Is Driving Precious Metals

The rally in Sibanye-Stillwater mirrors an unprecedented surge in precious metals prices across the board. Gold recently smashed through $5,300 per ounce, while platinum group metals (PGMs) have nearly doubled since mid-May 2025.

According to a Moneyweb report, the basket of four key metals the company produces—platinum, palladium, rhodium, and gold—jumped from R25,353 per ounce in mid-May to R50,406 currently. That's a straight doubling in less than a year.

What's driving this rally in precious metals? One word: chaos.

President Donald Trump's erratic tariff policies and foreign interventions have rattled global markets. His recent military action in Venezuela and threats to annex Greenland sent investors scrambling for safety. Gold benefits when uncertainty reigns, and right now, uncertainty is king.

BlackRock Isn’t Alone in This Bet

Sibanye-Stillwater has attracted an impressive roster of heavyweight investors beyond BlackRock. According to the Moneyweb report:

- The Public Investment Corporation, South Africa's largest fund manager for public servants' pensions, holds a 20.42% stake after adding another 2.4% last October. That makes the PIC the single largest shareholder.

- The second-largest shareholder is Lingotto Investment Management, controlled by Italy's Agnelli family. This industrial dynasty owns Fiat Chrysler, Ferrari, Juventus Football Club, and The Economist magazine. When families with century-old fortunes park money somewhere, people notice.

- BlackRock has also been loading up on other gold miners. The fund built a 10.1% stake in AngloGold Ashanti and increased its Harmony Gold position by more than 400% during 2025.

Why Sibanye-Stillwater stands out

What makes Sibanye-Stillwater different from pure gold plays is its diversified revenue mix. Traditionally, the company earned more than half its revenue from platinum group metals, with gold accounting for around a quarter. The rest came from recycling operations. That split is expected to shift more toward gold once the 2025 financial results are published, but diversification remains a key selling point.

Sibanye-Stillwater operates across multiple geographies as well. It has mining operations in South Africa and the United States, as well as a growing recycling business that processes industrial scrap and spent automotive catalysts.

While gold grabs headlines, the platinum story might be even more compelling. South Africa supplies more than 70% of the world's platinum. But production has been declining due to ongoing power issues, cost inflation, and falling ore grades. Supply constraints typically lead to higher prices over time.

Should you follow BlackRock?

BlackRock's move signals confidence in Sibanye-Stillwater, specifically, and in precious metals broadly. The fund has resources and research capabilities that retail investors can't match. But an almost 400% run-up means much of the easy money has already been made. Chasing stocks after huge rallies often leads to buying at peaks.

Analysts tracking SBSW forecast adjusted earnings per share to grow from $0.96 in 2025 to $3.69 in 2027. Its free cash flow is forecast to improve to $2.26 billion in 2027, compared to an outflow of $8 million in 2025. If SBSW stock is priced at 10 times forward FCF, it could surge 80% over the next 12 months.

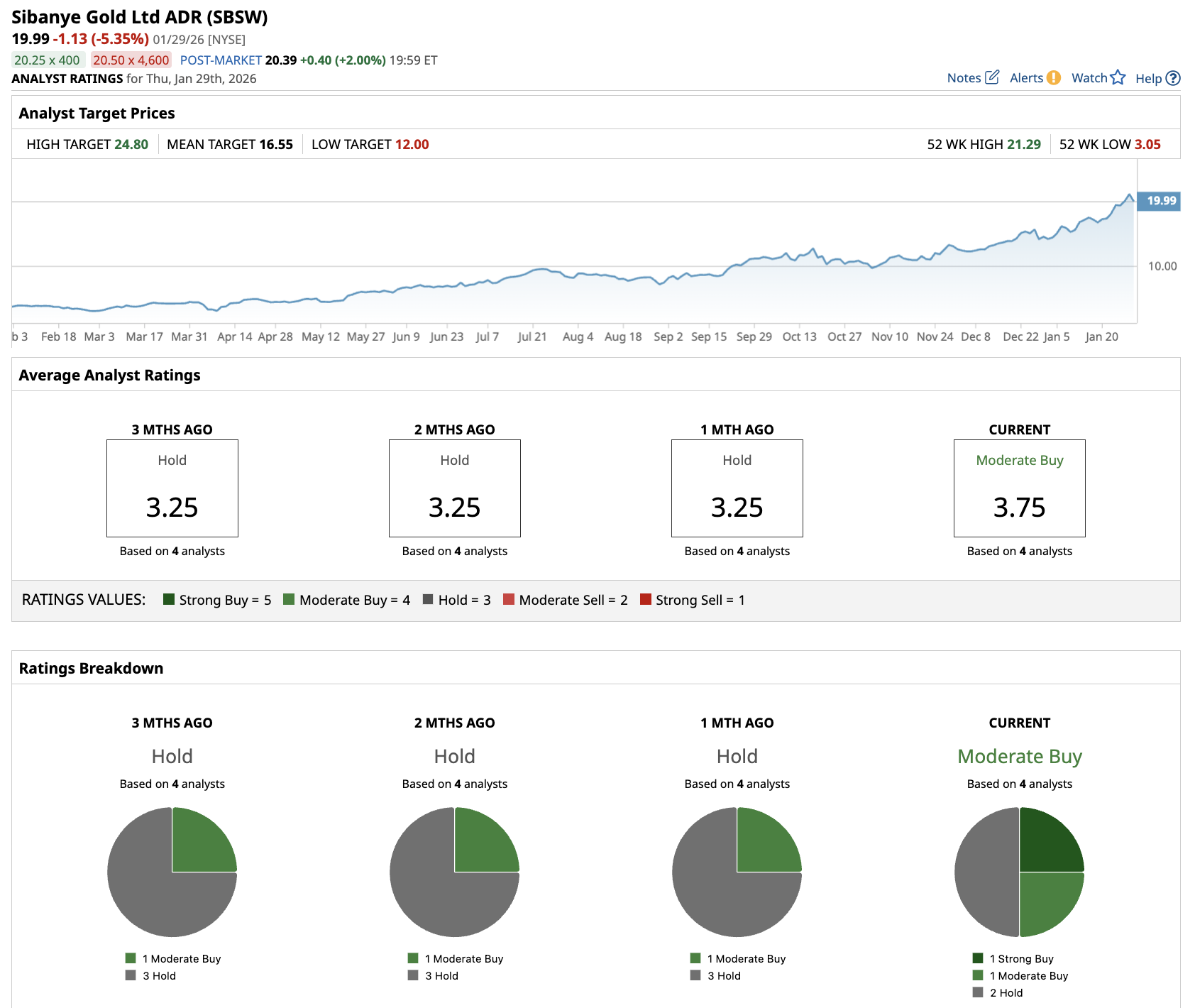

Out of the four analysts tracking SBSW stock, one recommends “Strong Buy,” one recommends “Moderate Buy,” and two recommend “Hold.” The average stock price target for the gold stock is $16.55, below the current price of about $20.

For investors who believe gold will continue to set records and that platinum supply constraints will persist, Sibanye-Stillwater offers leveraged exposure to both trends through a single stock.

The diversified revenue mix provides some cushion if one metal underperforms. The backing of sophisticated institutional investors such as BlackRock, the PIC, and the Agnelli family suggests that smart money sees value even after the rally.

Just remember that mining stocks amplify both gains and losses. What goes up fast can come down faster. Size your position accordingly, and don't bet money you can't afford to lose.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart