Denver, Colorado-based Newmont Corporation (NEM) is a gold mining company that is primarily engaged in the production of gold, with additional exposure to copper, silver, zinc, and lead as by-products. It is valued at a market cap of $144 billion.

This gold miner has significantly outpaced the broader market over the past 52 weeks. Shares of NEM have skyrocketed 219.1% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15%. Moreover, on a YTD basis, the stock is up 32.2%, compared to SPX’s 1.9% return.

Zooming in further, NEM has also outperformed the VanEck Gold Miners ETF (GDX), which rose 197.5% over the past 52 weeks and 30.8% on a YTD basis.

On Jan. 28, NEM shares climbed 3.9% as gold prices surged more than 3% to a fresh all-time high. The sharp rise in bullion prices boosted investor optimism around the miners’ earnings potential, cash flows, and margins, since higher gold prices directly improve revenue realization for producers like Newmont.

For the current fiscal year, ending in December, analysts expect NEM’s EPS to grow 81.9% year over year to $6.33. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

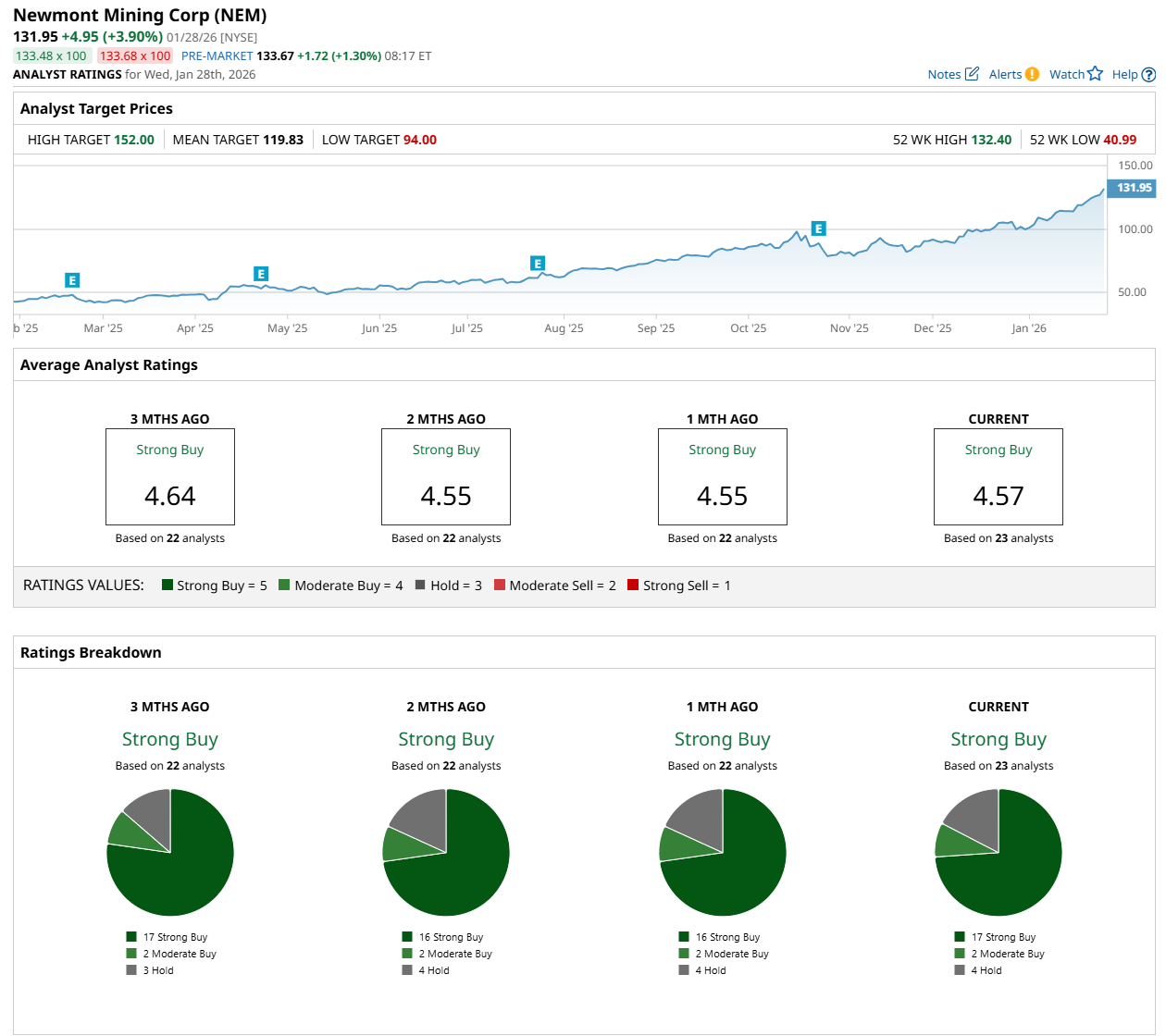

Among the 23 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 17 “Strong Buy,” two “Moderate Buy,” and four “Hold” ratings.

The configuration is more bullish than a month ago, with 16 analysts suggesting a "Strong Buy” rating.

On Jan. 26, The Bank of Nova Scotia (BNS) maintained an "Outperform" rating on NEM and raised its price target to $152, the Street-high price target, indicating a 15.2% potential upside from the current levels. The company is trading above its mean price target of $119.83.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Energy Stock Is Up 700%, But I Wouldn’t Touch It with a 10-Foot Pole

- PayPal Reports Q4 Earnings on Feb. 3. Why You Should Press Pause on PYPL Stock For Now.

- Analysts Love These 2 Picks-and-Shovels Gold Stocks. Should You Buy Them as Gold Prices Hit New Record Highs?

- Here’s a Critical Pick-and-Shovel Trade to Invest in the NIMBY Backlash Against AI Data Centers