Valued at a market cap of $33.7 billion, United Airlines Holdings, Inc. (UAL) provides air transportation services. The Chicago, Illinois-based company transports people and cargo through its mainline and regional fleets and also offers ground handling, flight academy, and maintenance services for third parties.

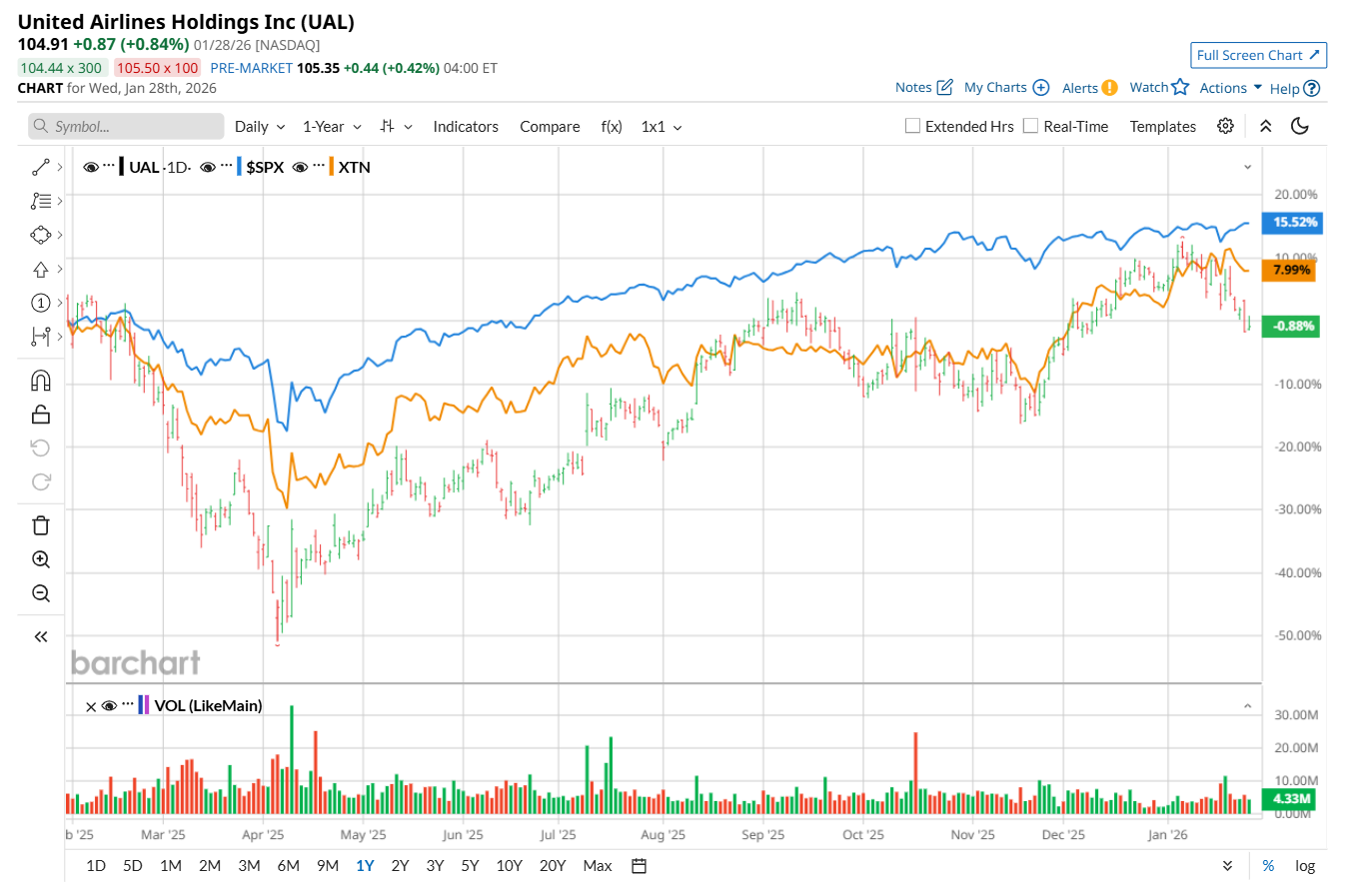

This airline company has underperformed the broader market over the past 52 weeks. Shares of UAL have declined 1.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15%. Moreover, on a YTD basis, the stock is down 6.2%, compared to SPX’s 1.9% return.

Narrowing the focus, UAL has also trailed the State Street SPDR S&P Transportation ETF (XTN), which rose 6.4% over the past 52 weeks and 5.7% YTD.

On Jan. 20, UAL reported impressive Q4 results, and its shares surged 2.2% in the following trading session. Mainly due to higher passenger revenue, the company’s total operating revenue reached a quarterly record of $15.4 billion, up 4.8% year-over-year and in line with Wall Street expectations. Meanwhile, due to lower operating margins, its adjusted EPS declined 4.9% from the year-ago quarter to $3.10, but topped analyst estimates.

For fiscal 2026, ending in December, analysts expect UAL’s EPS to grow 25.6% year over year to $13.34. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

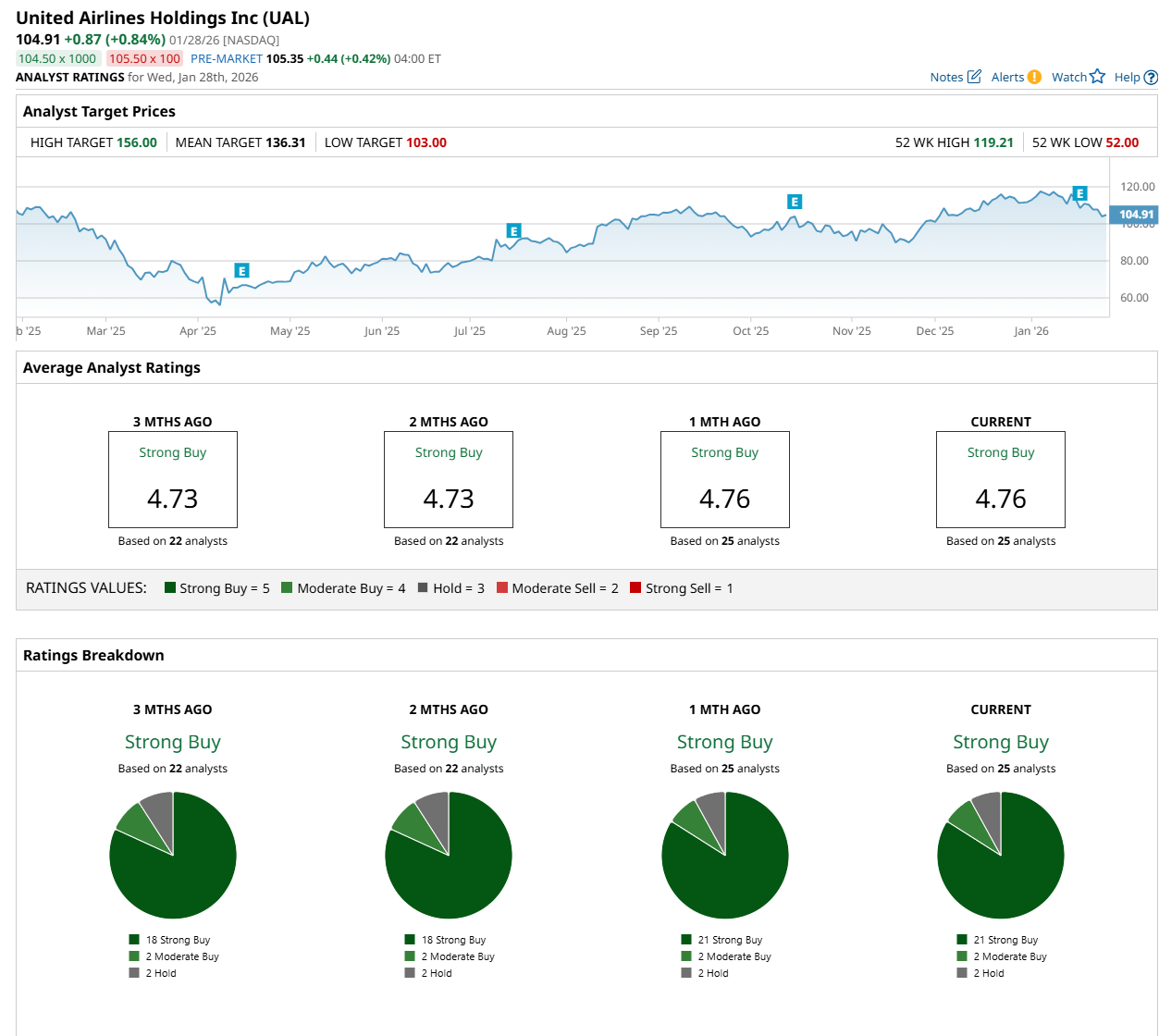

Among the 25 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 21 “Strong Buy,” two "Moderate Buy,” and two “Hold.”

The configuration is more bullish than two months ago, with 18 analysts suggesting a “Strong Buy” rating.

On Jan. 27, AllianceBernstein Holding L.P. (AB) maintained an "Outperform" rating on UAL and raised its price target to $136, indicating a 29.6% potential upside from the current levels.

The mean price target of $136.31 represents a 29.9% premium over UAL’s current price, while the Street-high price target of $156 suggests an ambitious 48.7% upside from current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Energy Stock Is Up 700%, But I Wouldn’t Touch It with a 10-Foot Pole

- PayPal Reports Q4 Earnings on Feb. 3. Why You Should Press Pause on PYPL Stock For Now.

- Analysts Love These 2 Picks-and-Shovels Gold Stocks. Should You Buy Them as Gold Prices Hit New Record Highs?

- Here’s a Critical Pick-and-Shovel Trade to Invest in the NIMBY Backlash Against AI Data Centers