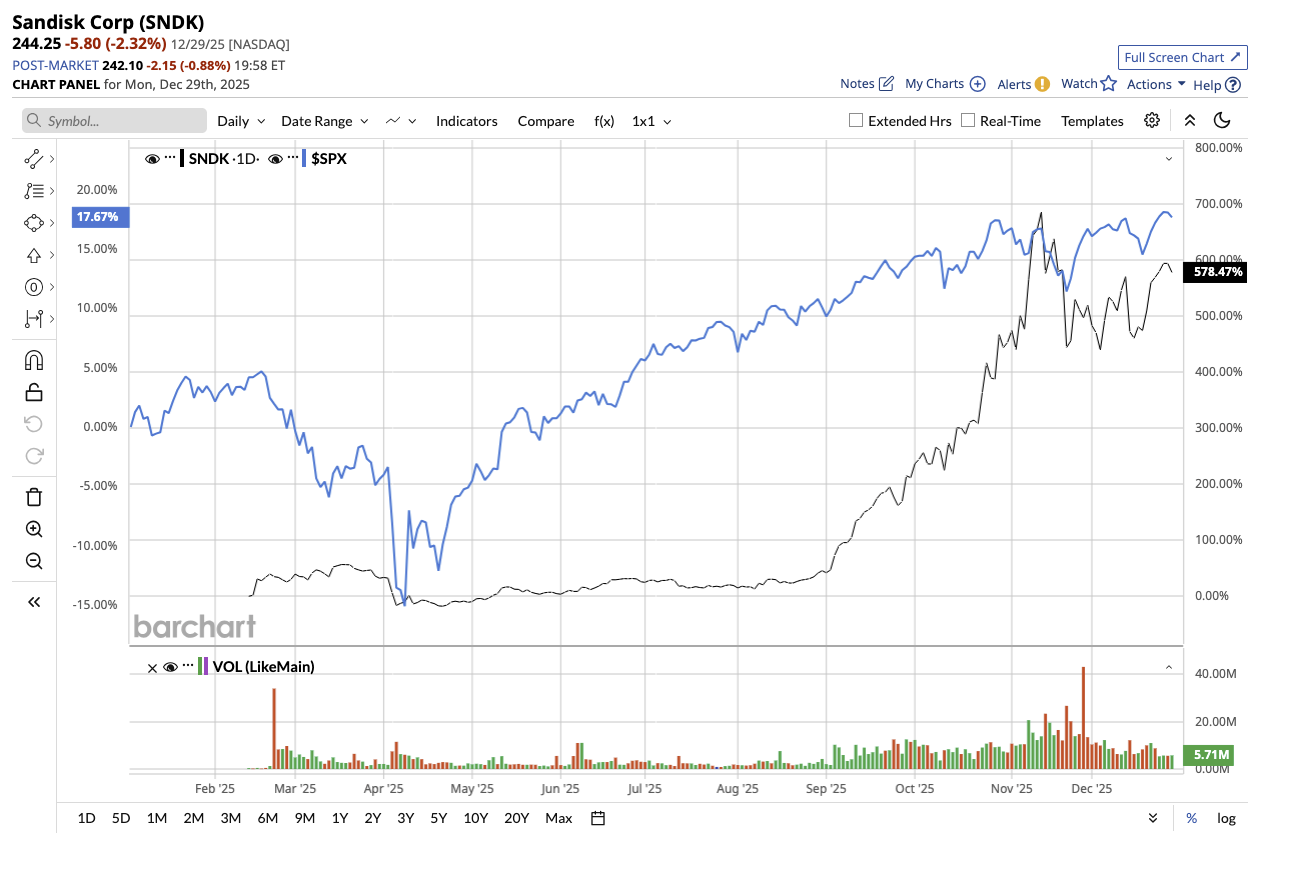

While many headline-grabbing stocks dominated investor attention in 2025, SanDisk (SNDK) delivered exceptional performance, soaring 578.5% year-to-date (YTD), setting itself up as a compelling name to watch heading into 2026. With earnings set to surge again and the stock still trading at a modest valuation, the question now is if this under-the-radar winner is still a buy for 2026.

Demand Is Outpacing Supply

Valued at $36.6 billion, SanDisk designs and sells high-capacity, high-performance solid-state drives (SSDs) used by cloud providers, hyperscalers, and enterprises to store and process massive amounts of data, especially for AI workloads.

SanDisk is growing increasingly relevant since its storage is essential for AI, cloud computing, and data-intensive applications. As AI models become larger and devices hold more data, the demand for fast and power-efficient flash memory grows, thereby helping SanDisk's core business. SanDisk started fiscal 2026 with an upbeat first quarter, reporting revenue of $2.3 billion, up 21% sequentially and 23% year-on-year (YoY). Earnings followed suit, with adjusted EPS rising to $1.22 from $0.29 in the prior quarter and adjusted gross margin reaching 29.9%. The data center segment saw a 26% sequential revenue increase owing to stronger partnerships with hyperscalers, neocloud providers, and OEMs. SanDisk is now working with five key hyperscale customers and has various SSD qualifications underway, highlighting the expanding use of its corporate storage solutions.

Notably, SanDisk's outperformance was largely due to a continuous supply-demand imbalance in NAND flash memory. This tight market has enabled SanDisk to make smart allocation decisions that promote long-term value generation while allowing for greater pricing and wider margins. SanDisk is benefiting directly from massive global investments in AI and data center infrastructure, which management predicts will exceed $1 trillion by 2030. Its BiCS8 technology, which is meant to provide industry-leading capacity, performance, and energy economy, is gaining traction rapidly. BiCS8 currently accounts for 15% of total bits supplied and is expected to account for the bulk of manufacturing by the end of fiscal 2026, boosting SanDisk's position in the data center, edge, and consumer markets.

SanDisk also maintains a strong cash position, generating $448 million in adjusted free cash flow in Q1, achieving a net cash position six months earlier than expected. It also ended the quarter with $1.4 billion in cash and equivalents.

A Quiet Winner Headed Into 2026?

Importantly, SanDisk's stock rise this year was not based on hype but on improving financials. SanDisk's 2025 performance has been anything but average, with strong end-market demand, improving margins, rising free cash flow, and a stable balance sheet.

Looking ahead, management expects second-quarter gross margins to increase to 41% to 43%, owing to pricing gains and favorable cost dynamics. Adjusted earnings could range from $3.00 to $3.40 per share in the coming quarter, indicating a significant increase in earnings power. Analysts forecast strong growth over the next two fiscal years. Earnings are predicted to increase threefold to $13.02 per share in fiscal 2026, followed by another 58.7% increase in fiscal 2027, indicating that growth is not a one-time spike but rather part of a multi-year cycle. SanDisk, trading at 11 times forward earnings, remains a cheap AI stock to buy now, given its growth and AI exposure.

Management stated that demand for its NAND products continues to outpace supply, a trend that is likely to persist through calendar year 2026 and possibly beyond. As AI-driven storage demands continue to rise and supply remains tight, the company is well positioned to maintain its momentum through 2026, making this quietly dominant, undervalued AI stock investors should keep an eye on.

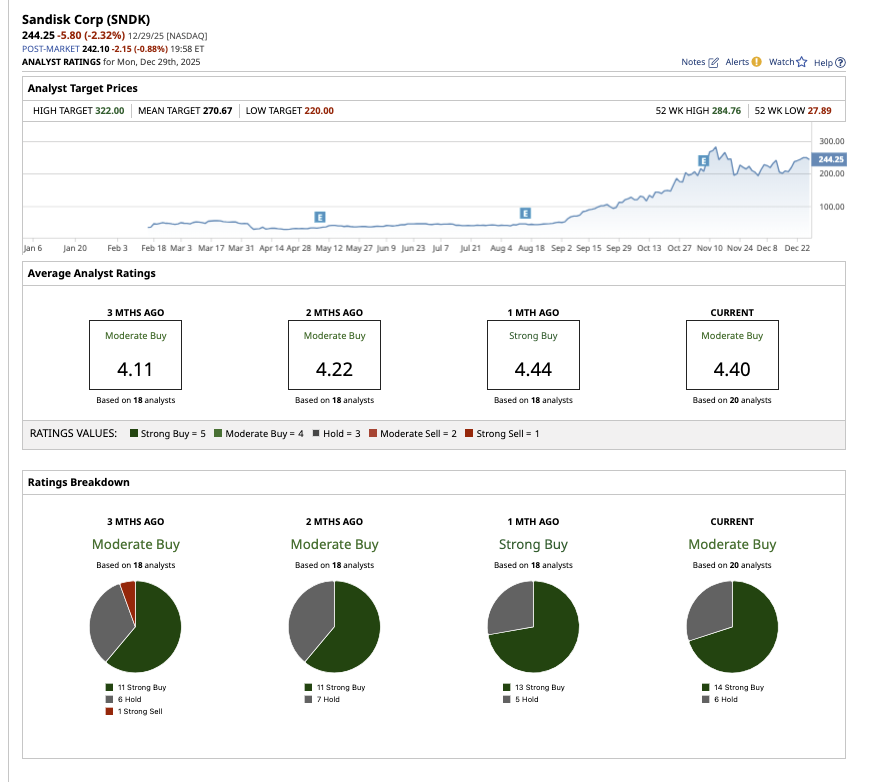

Is SNDK Stock a Buy, Hold, or Sell on Wall Street?

Overall, SNDK stock is rated a “Moderate Buy” on Wall Street. Of the 20 analysts covering the stock, 14 have given it a “Strong Buy” rating, and six recommend a “Hold.” The average target price is $270.67, indicating a potential upside of 10.8% from its current price. Additionally, the highest target price of $322 suggests the stock could rise by as much as 31.8% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart