Gen Digital Inc. (GEN), headquartered in Tempe, Arizona, is a global leader in cybersecurity and digital protection. The company offers advanced technology solutions safeguarding digital and financial lives through well-known brands like Norton, Avast, LifeLock, and MoneyLion.

Serving nearly 500 million users worldwide, Gen Digital focuses on empowering individuals to live securely in the digital era, combining AI-driven innovation with trusted cybersecurity, privacy protection, and financial wellness products. The company has a market capitalization of $16.19 billion.

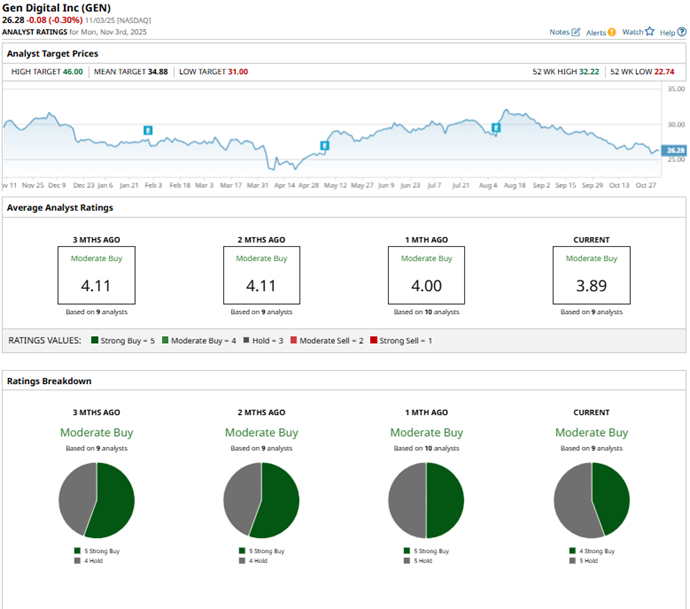

Cautious investor sentiment and broader market fluctuations have taken a toll on Gen Digital’s stock performance. Over the past 52 weeks, the stock has been down by 7%, while it has gained a modest 1.4% over the past six months. It had reached a 52-week high of $32.22 in August, but is down 18.4% from that level.

The stock has broadly underperformed the S&P 500 Index ($SPX), which has gained 19.6% over the past 52 weeks and 20.5% over the past six months. Turning our focus to the company’s own tech sector, we see that the stock has underperformed here as well, while the Technology Select Sector SPDR Fund (XLK) is up 34.8% over the past 52 weeks and 39.4% over the past six months.

Gen Digital reported solid results for the first quarter of fiscal 2026 (the quarter that ended on July 4). The company’s net revenues climbed by 30.3% year-over-year (YOY) to $1.26 billion, while its total bookings increased by 31.7% from the prior year’s period to $1.20 billion. Based on the solid results, Gen Digital raised its fiscal 2026 revenue guidance from $4.70 billion - $4.80 billion to $4.80 billion - $4.90 billion.

Wall Street analysts are exceptionally bullish about Gen Digital’s bottom-line trajectory. For the fiscal year 2026, which ends in March 2026, Wall Street analysts expect the company’s EPS to increase 12.9% YOY to $2.27 on a diluted basis. EPS is also expected to increase 15.4% to $2.62 in fiscal 2027.

For Q2 FY2026 (which is set to be reported on Nov. 6 after the market closes), EPS is projected to increase 12.2% annually to $0.55. On the other hand, the company has missed consensus EPS estimates in three of the four trailing quarters.

Among the nine Wall Street analysts covering Gen Digital’s stock, the consensus is a “Moderate Buy.” That’s based on four “Strong Buy” ratings and five “Holds.” The ratings configuration is less bullish than it was a month ago, with four “Strong Buy” ratings, down from five in the previous configuration.

Last month, analysts at Jefferies maintained their “Hold” rating on Gen Digital’s stock, while giving a price target of $31. While Jefferies analysts see near-term execution risk, particularly in the short term due to issues with its MoneyLion acquisition, the move is expected to broaden Gen Digital’s business in the longer term.

Gen Digital’s mean price target of $34.88 indicates a 32.7% upside over current market prices. The Street-high price target of $46 implies a potential upside of 75%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart