Context Analytics Launches ASX Asset Class to Social Media Feeds

CHICAGO, ILLINOIS / ACCESS Newswire / April 16, 2025 / Context Analytics, a leading provider of AI-driven financial data solutions, proudly announces the launch of its Twitter-based sentiment feed for the Australian Securities Exchange (ASX). This latest expansion delivers comprehensive real-time social sentiment analytics for over 860 securities, enabling greater global coverage and deeper market insights for institutional investors and trading firms.

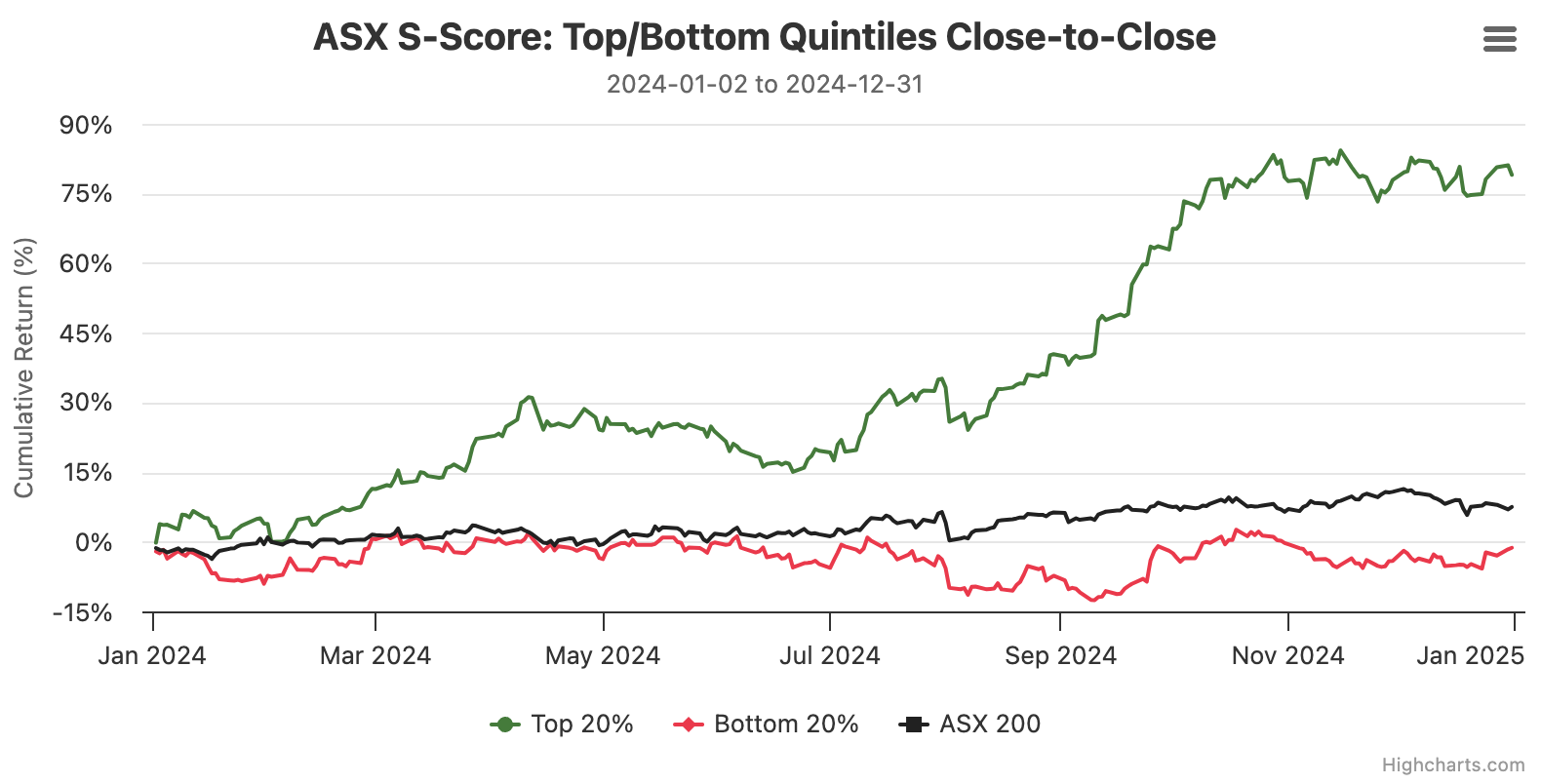

Top 20% and bottom 20% of securities with a sentiment score prior to market close each day

With data coverage beginning in 2015 and an out-of-sample validation start date of March 1st, 2025, this new ASX dataset mirrors Context Analytics' established methodology for other global equity markets. The feed delivers S-Factor (sentiment score) and Activity data every minute, available via API or FTP, supporting advanced quantitative models and alpha-generating strategies.

To demonstrate the predictive power of the dataset, Context Analytics analyzed the cumulative returns of securities in the top and bottom 20% of sentiment scores prior to market close:

Portfolio |

Cumulative Return |

Volatility |

Sharpe |

Sortino |

Avg. S-Score |

Avg. Count |

|---|---|---|---|---|---|---|

Top 20% |

79.02% |

21.50% |

2.80 |

4.88 |

3.49 |

25 |

Bottom 20% |

-1.29% |

18.95% |

0.03 |

0.05 |

-1.46 |

25 |

ASX 200 Index |

7.52% |

11.39% |

0.69 |

1.06 |

|

|

As seen in the results, securities with the highest sentiment scores consistently outperformed the ASX 200 benchmark in 2024, while those with the lowest scores underperformed-highlighting the model's effectiveness in identifying alpha-generating opportunities. Each portfolio was rebalanced daily based on updated sentiment prior to market close, with approximately 125 securities receiving sentiment scores daily throughout the year.

"Our mission is to transform unstructured data into actionable insights," said Joe Gits, CEO of Context Analytics. "With the addition of ASX securities, we are continuing our global expansion and delivering institutional-grade social sentiment analytics to new markets."

Context Analytics' proprietary sentiment signals are already used by major asset managers, hedge funds, and exchanges. The company's growing global coverage ensures clients can tap into uncorrelated, real-time intelligence across diverse equity markets.

To learn more about Context Analytics' sentiment solutions or to request access to the ASX dataset, please visit www.contextanalytics-ai.com.

Contact Information

Madison Wray

Business Development Analyst

madison@contextanalytics-ai.com

(312) 788-2607

SOURCE: Context Analytics, Inc.

View the original press release on ACCESS Newswire