Learn how fractional ownership and digital platforms make global real estate investing accessible and hassle-free for everyone.

DUBAI, UNITED ARAB EMIRATES / ACCESSWIRE / July 14, 2024 / Digital platforms like GulfEstate are changing how people invest in real estate. By using a fractional ownership model, people can buy and own parts of a property instead of the whole thing.

This model enables aspiring investors around the world to acquire shares in rental properties for as little as $150 USD while receiving all the associated benefits, such as rental income and capital appreciation.

How it works:

Real estate experts choose properties with the best return rates globally. In upcoming cities, like Dubai, rental returns can reach 20% per year. Selected properties are listed on the platform where investors acquire shares. The property is then managed by experts and rental profits are distributed monthly, and when properties are sold, returns go to investors.

This is possible thanks to a crowdfunding and fractional ownership model. The funds from all investors are pooled to purchase the property, and then GulfEstate manages all time-consuming aspects of property ownership, from tenant selection to maintenance, making it a hassle-free investment for the platform users.

The benefits:

Traditionally, property investment was reserved for the wealthy and those willing to take loans. Even then, it required time-consuming management and extensive market knowledge. GulfEstate is changing that, enabling everyone to build wealth by investing in real estate. The key advantages are:

• Accessibility: The low entry point opens up real estate investing to a broader audience, democratizing access to potentially lucrative markets.

• Diversification: Investors can spread their capital across multiple properties and locations, reducing risk.

• Liquidity: Compared to traditional real estate investments, fractional ownership offers improved liquidity options.

• Passive Income: Regular rental income provides a steady stream of passive earnings.

• Professional Expertise: Investors benefit from the knowledge and experience of real estate professionals in property selection and management.

• Global Reach: Access to international property markets that may have been out of reach for individual investors.

Unlike some European platforms, GulfEstate follows an equity crowdfunding model, where no debt-related products are sold to users. While this may yield lower potential returns, it has significantly reduced risks as only tangible real estate properties are offered for investment rather than development projects.

The technology behind it:

GulfEstate's platform uses advanced technology to make investing simple and secure.

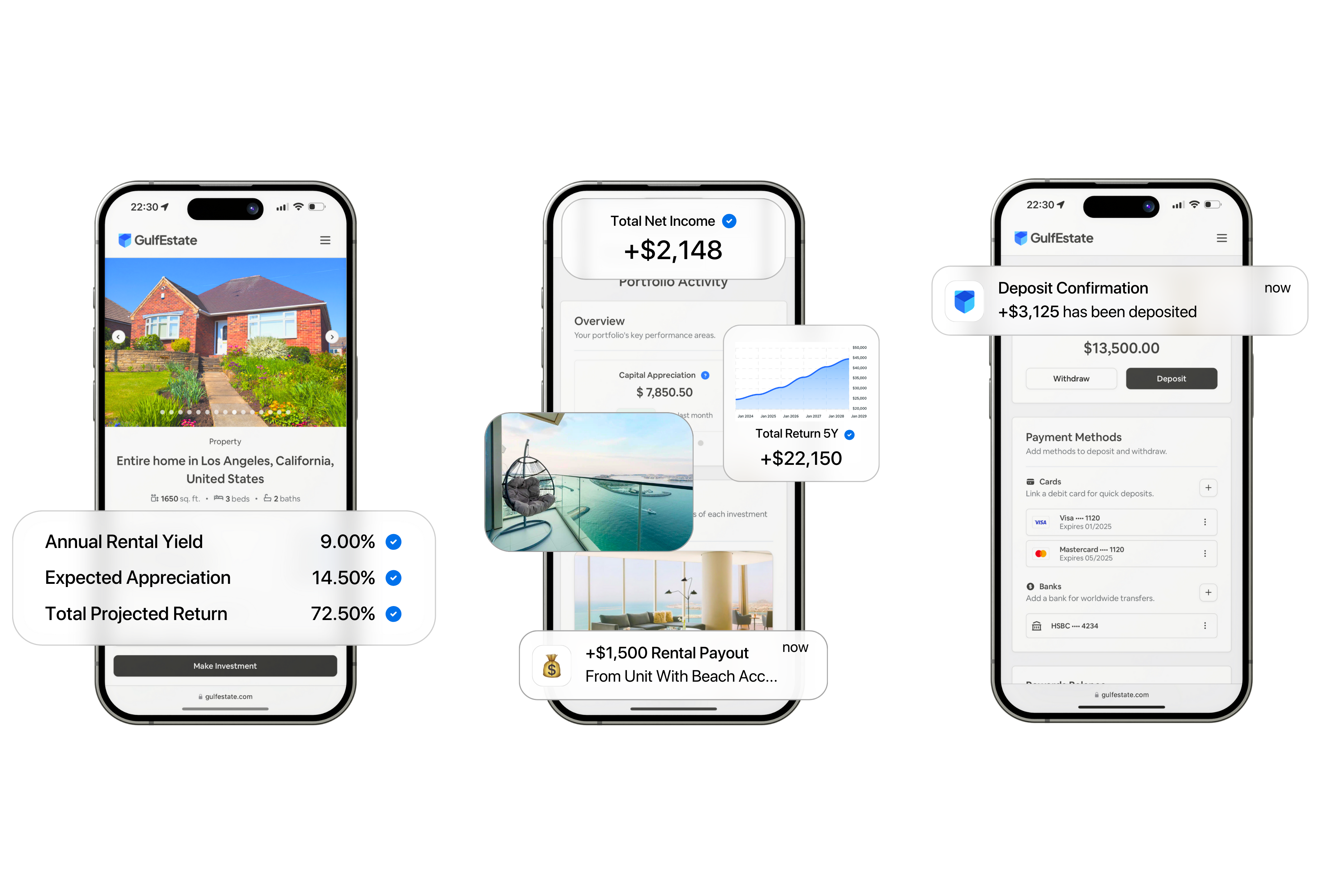

The platform is accessible through a website and mobile apps for Android and iOS devices. Investors can view property details, track their investments, make deposits or withdrawals, and receive rental payments. This technology also allows for quick and easy transactions, making it possible to invest in properties around the world from anywhere.

Proprietary algorithms are used backstage to conduct complex data analysis and forecasts, aiding real estate experts in the process of screening and selecting investment opportunities to be listed on the platform. GulfEstate is also working to implement a peer-to-peer market where investors can sell their property shares before the investment period is over. This would enhance liquidity and solve one of the greatest drawbacks of real estate investing.

Potential returns:

Rental returns can vary significantly depending on the location, but many markets around the world offer attractive yields. Traditionally, investing in foreign markets presented significant challenges due to legal requirements, overseas management, and a lack of transparency. GulfEstate is changing that, empowering investors to build an international portfolio from their phones. The average properties listed on the platform boast 6-12% net annual rental yields, paid monthly.

In addition to rental income, investors can benefit from property value appreciation. Real estate markets can experience significant growth over time, leading to substantial returns when properties are sold. As an example, Dubai's property market has seen remarkable surges, with some areas experiencing an appreciation of over 100% in just a few years. While such dramatic increases aren't guaranteed or typical in all markets, this illustrates the potential for significant capital gains in addition to rental income.

About the company:

GulfEstate was founded by a team of real estate and technology experts aiming to make property investing accessible to everyone. Currently based in Dubai and working to expand their presence in the European and Asian property markets. The business model is straightforward and aligns the company incentives the best interest of the investors, by charging transaction and performance-based fees it compels the company to make long-term choices that will benefit its investors.

The company's CEO says, "We want to make real estate investing available to everyone, not just the wealthy. Our platform makes it easy and safe for people to invest in property, no matter where they live." GulfEstate manages all aspects of property ownership, from tenant selection to maintenance, making it a hassle-free investment model. Allowing investors to benefit from global real estate markets without high capital requirements, market knowledge, or management responsibilities.

Risk Mitigation & Regulation:

The risk mitigation strategies employed by GulfEstate stem from compliance and adherence to regulatory frameworks established by local and international authorities for Real Estate Property Crowdfunding Platforms and other relevant guidelines. The platform and business model have been designed to achieve regulatory compliance and therefore have multiple built-in risk mitigation strategies that aid in protecting users from conflicts of interest and safeguarding their assets.

The GulfEstate platform offers complete transparency on all details regarding the properties listed on the platform, their forecasted returns, and proposed management strategies as well as complete financial breakdowns for fund allocation.

Appropriate legal structures are set up for holding and managing each property, effectively limiting user liabilities. Stringent Identity Verification (KYC) and Anti Money Laundering (AML) procedures are in place to guarantee the safety and integrity of our platform and community. The best practices and state-of-the-art Cybersecurity measures are employed coupled with regular checks conducted on all areas of the platform's digital-facing infrastructure to protect user data. Financial assets are held and protected by licensed banks and custodians.

Conclusion:

As more people learn about this new investment model platforms like GulfEstate set for a rapid expansion, enabling unprecedented access and inclusivity to potentially lucrative opportunities that were previously out-of-reach for everyday people aspiring to build and grow wealth.

Media Contact:

Rachel Harris

Pulse Media

info@pulsemediapr.com

SOURCE: GulfEstate

View the original press release on accesswire.com